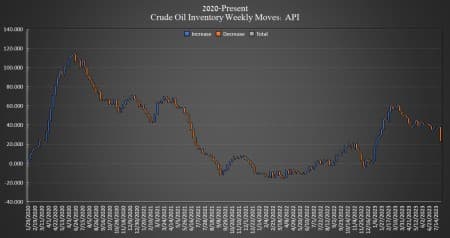

Crude oil inventories in the United States unexpectedly fell sizably this week by 15.4 million barrels, the American Petroleum Institute (API) data showed on Tuesday after increasing by 1.319 million barrels in the week prior.

Analysts were expecting a draw of 900,000 barrels in U.S. crude-oil inventories. The total number of barrels of crude oil gained so far this year is 20 million barrels, according to API data, although the net draw in crude inventories since April is 27 million barrels.

On Monday, the Department of Energy (DoE) reported no change for the third week in a row to the inventory held in the Strategic Petroleum Reserve (SPR) in the week ending July 28, with the SPR inventory still sitting at a 40-year low of 346.8 million barrels.

The price of WTI and Brent were both trading down on Tuesday in the run-up to the data release. By 4:18 p.m. EST, WTI was trading down 0.09%, at $81.73 per barrel—up more than $2 per barrel since last Tuesday, while Brent crude was trading down 0.20% at $85.26—up just under $2 this from this time last week.

Gasoline inventories saw another draw this week, falling by 1.68 million barrels after falling 1.043 million barrels in the week prior, with inventories already 7% less than the five-year average. Distillate inventories fell by 512,000 barrels, compared to the 1.614 million barrel build in the week prior.

Crude oil production in the United States slipped to 12.2 million bpd for the week ending July 21, according to EIA data, flat compared to production levels at the start of the year.

Inventories at Cushing, Oklahoma, fell by another 1.76 million barrels, after falling by 2.34 million barrels in the previous week.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

from "price" - Google News https://ift.tt/9ZBid27

via IFTTT

No comments:

Post a Comment