jentakespictures

With Lululemon (NASDAQ:LULU) set to report its Q2 earnings at the end of the month, I wanted to preview its earnings. The stock is up over 25% since my initial bullish write-up in March, easily outpacing the over 12% gain in the S&P. I also raised my price target in July to $450, as the company showed continued sales momentum in Q1 despite an uncertain macro environment and consensus estimates had increased based since my original write-up based on the company's solid performance. However, based on recent commentary from luxury brands on the U.S. consumer, some caution may be warranted ahead of earnings. As such, I'm less bullish in the near term, although my long-term view remains unchanged.

Company Profile

As a refresher, LULU is an upmarket athleisure brand known for its yoga pant. The company also sells other athletic apparel including shorts, tops, jackets, as well as other items and accessories. While women are its main customers, it also has a growing men’s business.

The retailer mainly sells its items through its own stores and e-commerce platform. It had 662 stores around the globe at the end of fiscal Q1. To a lesser extent, the company also sells its apparel through other channels such as pop-up stores, wholesale, and outlets.

The company also owns an interactive workout platform through Lululemon studio (Mirror) that it is reportedly looking to sell.

Earnings Preview

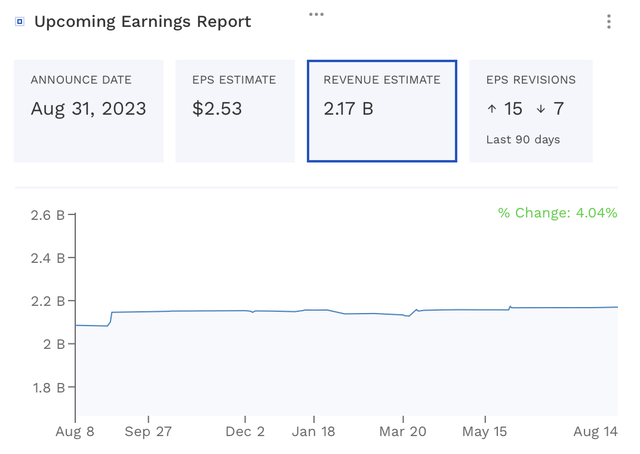

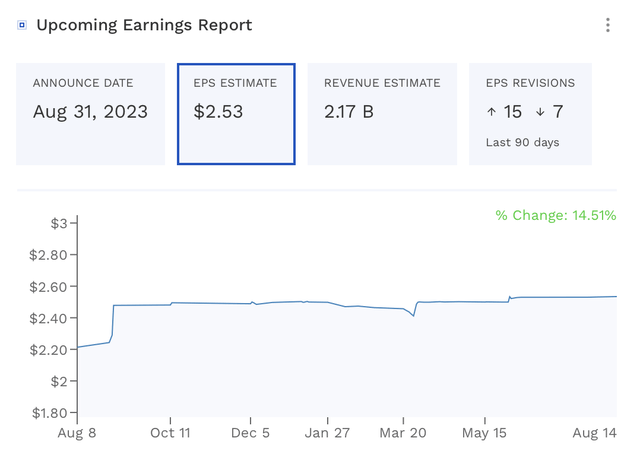

For the fiscal second quarter, analysts are looking for LULU to grow revenue 16.1% to $2.17 billion. They are expecting adjusted EPS to climb 11.4% to $2.64. The company grew revenue 24% to $2.0 billion in Q1, so analysts are expecting growth to decelerate in Q2.

For its part, the company forecast Q2 revenue of between $2.14-$2.17 billion, representing growth of 15-16%. It forecast EPS to be between $2.47-$2.52. The fiscal Q2 revenue consensus is at the top end of LULU’s guidance, while the EPS consensus is above the top end of its forecast. LULU also said that it is looking for gross margins to improve by 200-220 basis points in the quarter.

For the full year, the retailer upped its guidance on its Q1 call to sales of $9.44-$9.51 billion, representing growth of 16-17%, and EPS of $11.74-$11.94.

Analyst expectations for fiscal Q2 revenue have move slightly higher throughout the past year, increasing 4% over the past 12 months. Estimates are up 0.6% since late May.

FinBox

Q2 EPS estimates, meanwhile, are up a14.5% over the past year. Estimates are up 3 cents from late May.

FinBox

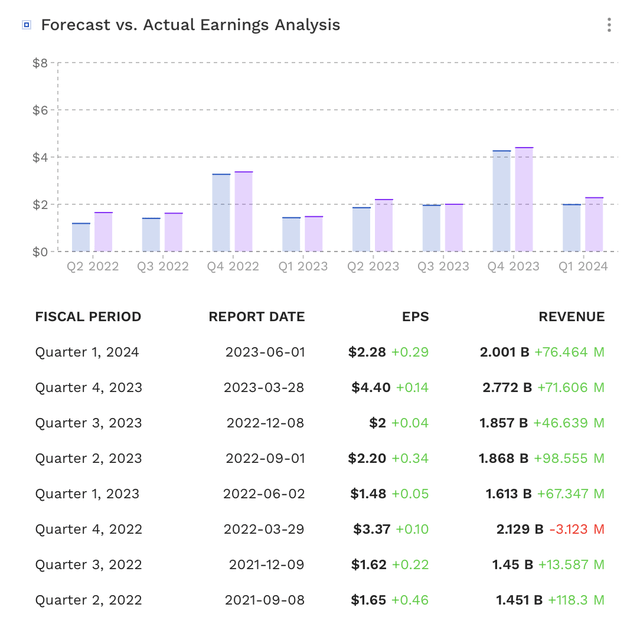

When looking at past earnings, LULU has beaten the consensus revenue number in seven of the eight quarters over the past two years. The one miss was a very small $3 million miss in Q4 of 2022 on $2.13 billion in revenue.

FinBox

For EPS, the company has beaten estimates each of the past eight quarters, with its smallest beat be 4 cents in Q3 of fiscal 2023 and its largest being a 46 cent beat in Q2 of 2022.

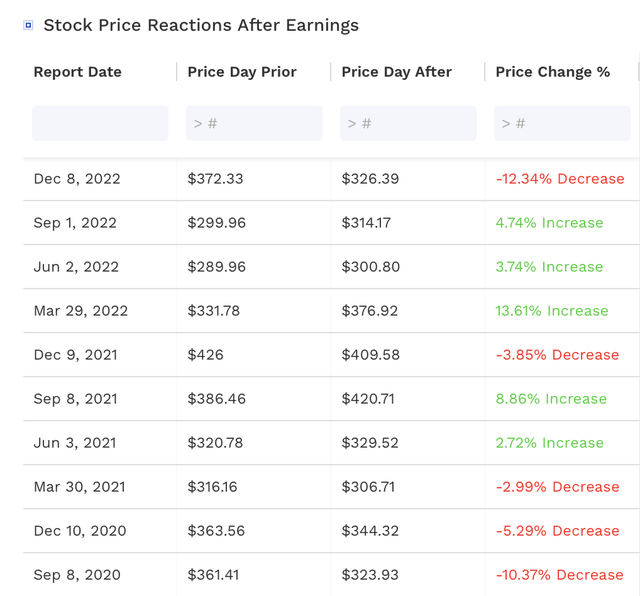

With the strong performance, LULU’s stock has had generally had a solid reaction to its earnings reports. The stock has risen the next session in 7 of the past 10 quarters. More recently, the stock has risen in 5 of the past 6 quarters.

FinBox

During the past two and half years, the stock has made a move over 10% or more four times, including rising 10% the next session last quarter. Its best performance was a 13.8% increase in fiscal Q4 of 2023, while its worst performance was a decline of -12.3% in fiscal Q3 of 2023. Market reactions for fiscal Q2 results have been varied, from a decline of -10.4% in fiscal 2021 to an increase of 8.9% in fiscal 2022 over the past 3 years.

Discussing the potential impact of the macro environment and competition of its fiscal Q1 earnings call, CEO Calvin McDonald said:

“And in terms of competitive and macro, we continue to, as we always have, monitor the actions that are taking place both in the competitive land -- I think I've talked before about pricing. That was a strategic decision last year to take very minimal price activity, and that allowed us to continue to support our full-price selling, in particular, when most others had to course-correct and pull the promotional lever to adjust. And we're going to continue to manage that. We are seeing inventory levels come in better positioning. So although I'm anticipating further discounting in the marketplace, I don't expect it will be worse than it has been, and our business has continued to perform well during that heavily promoted period. And as you saw, we got our inventory this quarter ahead of guidance and in line with our revenue number. So from a competitive perspective, I think we're well positioned and have an exciting, innovative pipeline of product to come for the back half of this year, and that always fuels our business. And I'm excited with what I see and what's coming for both the male guest and our female guest. On macro, with the uncertainty, as we've done for the past 2 years, we're going to continue to plan the business for multiple scenarios, monitor it. Our guest metrics were healthy in Q1 in terms of both traffic transaction and new guest acquisition, but we're continuing to monitor and we'll adjust as we need to.”

Investors will likely be focusing on revenue and gross margins, both in terms of actual numbers and guidance. How the company is progressing in China will also likely be a topic of focus. Overall, the LULU’s guidance looked pretty conservative; however, luxury brands did see some pressure in the U.S. coming from aspirational customers, so this is something to be wary of moving forward.

On its Q2 earnings call, LVMH CFO Jean-Jacques Guiony:

"So all in all, we experienced a little bit of pressure with the American customer to varying degrees amongst brands. Some are more subject to this than others. But all in all, we have a situation where, by and large, the aspirational customer is suffering a bit. We are experiencing drops with enterprise products with online sales with second-tier cities, which is a clear sign that the aspirational customer is not shopping as much as they used to."

Given LULU's long history of under-promising and overdelivering, I'd expect nothing to change on that front, and for the company to handily beat revenue and EPS estimates. However, given the cautious commentary of U.S. aspirational buyers from the heads of some leading luxury brands when they reported their quarterly earlier this earnings cycle, I would expect continued cautious guidance from LULU, which might disappointment investors and send the stock lower. I am particularly wary of the smaller men's segment, which has a less fervent customer base and saw growth starting to slow last quarter.

Valuation

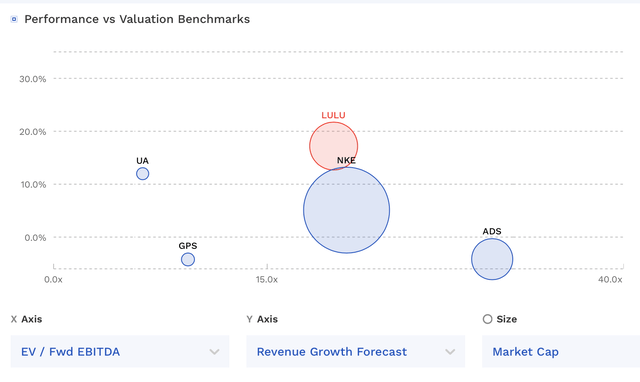

LULU currently trades around 19x the FY 2024 (ending January) consensus EBITDA of $2.49 billion and 16.8x the FY25 consensus of $2.82 billion.

It trades at a forward PE of 31.1x the FY24 consensus of $11.94, and 27.0x the FY25 consensus of $13.74.

It’s projected to grow revenue 17% this fiscal year and 13% next fiscal year.

LULU continued trades at discount to rival Nike (NKE), despite its must faster growth, but the gap has closed considerably since I first started writing about LULU.

LULU Valuation Vs Peers (FinBox)

Conclusion

LULU continues to be a strong growth brand, and its popularity with North American women, is undeniable. It's strength as an upscale brand and growth opportunities internationally, especially in China; in the men's category; and continued innovation in the women's category, to go along with a valuation less than NKE despite better growth and operational performance is why I have been bullish on the name for much of this year. And so far, the stock has delivered.

However, I’m not sure if the brand is completely immune to the macro and competition, and the recent U.S. results from luxury brands this past quarter is showing some softness. I feel the smaller men’s segment could be more vulnerable, as it did see its Q1 growth start to slow. Given this risk, I would not be a buyer of the stock in the near term and would prefer to wait on a potential earnings pullback.

That said, even if LULU were to have an earnings hiccup or issue softer- than-expected guidance, my long-term view on the name would not likely change. This is a great business with some nice growth drivers still ahead - I particularly like its long-term prospects in China, which its consumers are just starting to recover from their Covid lock-downs. New money investors, however, may want to wait until after earnings to pick up shares.

My price target of $450 remains, which is a 20x multiple on FY25 EBITDA estimates. That is about 19% upside from here, which is a solid return, but not enough to jump in ahead of earnings.

from "price" - Google News https://ift.tt/MUzVwcq

via IFTTT

No comments:

Post a Comment