Deepak Sethi/E+ via Getty Images

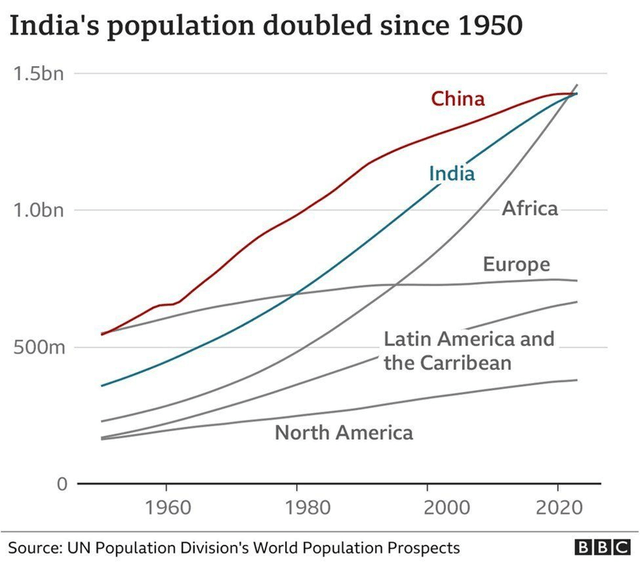

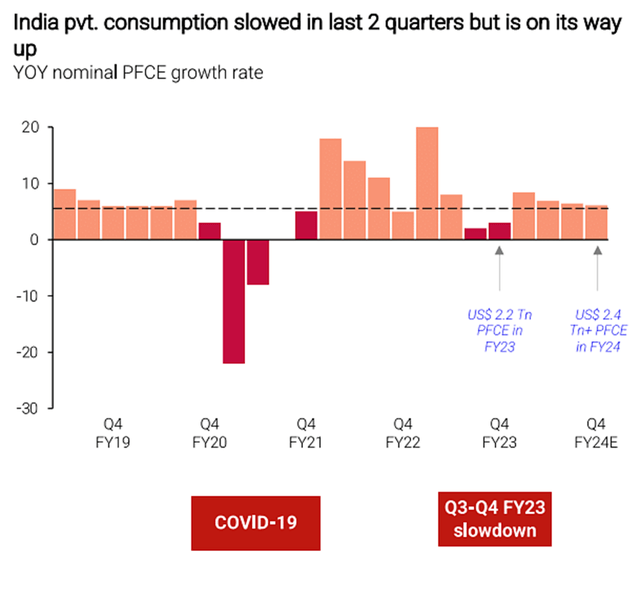

India's economy has outshined the rest of its Asian peers this year, with GDP growth tracking in the high-single-digits % and leading PMI indicators consistently notching new highs (this month's services PMI at >62) against a slowing global backdrop. In contrast, China has faltered since the reopening, as both geopolitics and elevated debt constraints weigh on the near and long-term growth potential. As a result, India looks poised to take the baton as the new global growth engine; the key difference being its leverage to consumption (note >60% of India's GDP is domestic consumption-driven) supported by structural demographic factors. And unlike China, India stands to benefit from a multipolar shift; recent deals across both sides of the geopolitical divide (e.g., partnerships with the US and oil deals with Russia) are a case in point.

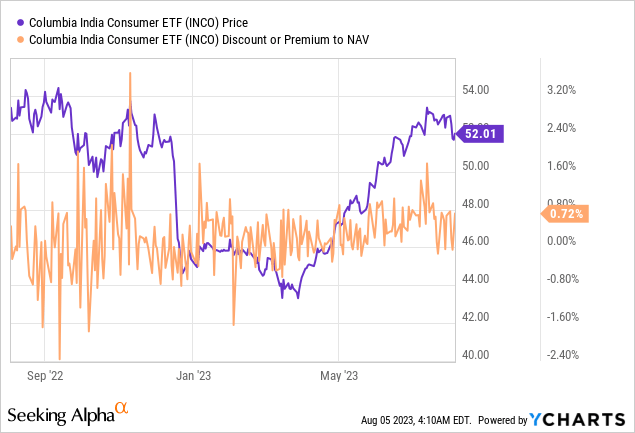

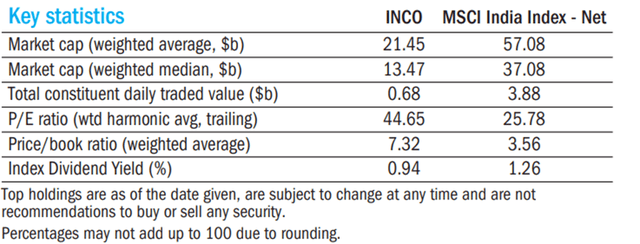

The catch is that valuations already screen very richly at ~45x P/E for the established franchises within the Columbia India Consumer ETF (NYSEARCA:INCO). But given the structural tailwinds underpinning Indian consumer earnings growth, I still see ample room for INCO's portfolio to grow into its valuation over time.

Fund Overview – A High-Quality Consumer-Focused ETF

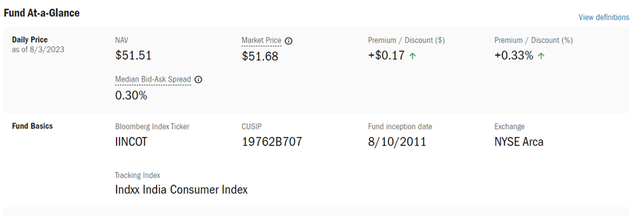

The US-listed Columbia India Consumer ETF tracks (pre-fees and expenses) the performance of the market cap-weighted Indxx India Consumer Index, a basket of India's largest consumer staples and discretionary names (as defined by Indxx) subject to size, liquidity, and weightage constraints. Despite the outperformance in recent months, INCO maintains a ~0.8% expense ratio (0.77% gross; 0.75% net of fee waivers), making it a reasonably-priced single-country/single-sector (consumer) option for US investors.

Columbia Threadneedle

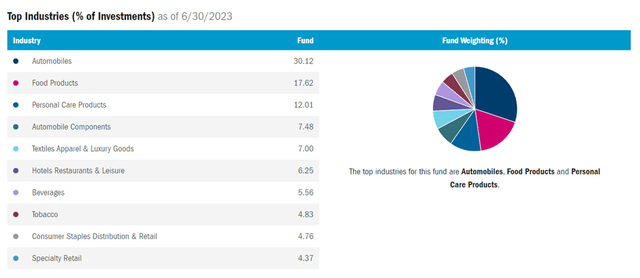

The fund's sub-sector allocation has shifted further toward discretionary post-Q2 at 55.2% (up from ~53% previously), with the remaining 44.8% from consumer staples. By industry, the portfolio composition has also skewed further toward the largest holdings, with Automobiles rising to 29.9% this quarter (albeit still down from the ~35% at the start of the year) and Food Products holding on to its Q1 portfolio gains at 17.5%. In contrast, Personal Products, Automobile Components, and Textiles Apparel & Luxury Goods have ceded share of the portfolio. Alongside Hotels, Restaurants & Leisure and Beverages, however, these industries remain well above the >5% threshold. On a cumulative basis, the top five sectors still contribute an outsized ~74% of the total portfolio; the concentration on auto and auto components (up to ~37% in Q2) also stands out.

Columbia Threadneedle

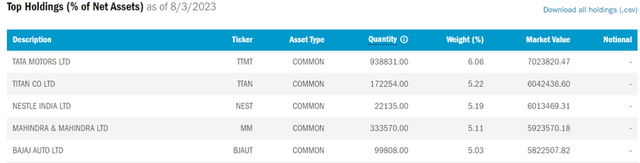

The INCO single-stock portfolio, capped at 30 holdings, remains skewed toward leading automotive manufacturer Tata Motors (TTM), albeit at a slightly lower 6.1% weightage. Mahindra & Mahindra (OTC:MAHMF) and two-wheeler manufacturer Bajaj Auto are the other big auto holdings at 5.1% and 5.0%, respectively. Of note, food & beverage giant Nestle India (OTC:NSZTY) has held on to last quarter's gains, contributing a 5.2% allocation, while jeweler Titan Co Ltd (OTC:TQTQY) is now the second-largest holding at 5.2%. With the top-five holdings only making up ~27% of a 30-stock portfolio, INCO's weightage cap has helped to keep things fairly spread out from a single-stock perspective.

Columbia Threadneedle

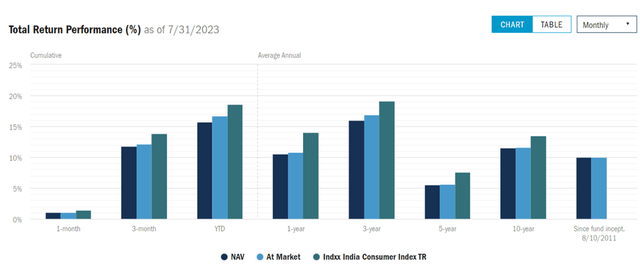

Fund Performance – Perennially Pricey but Still Making Impressive Gains

INCO has, like other Indian ETFs, been on a tear over the last few months. The Q2 gain was particularly strong at +17.2%, driving the fund's YTD total return to +14.5% (+15.5% in market price terms). Additionally, the Q2 rally has driven INCO's annualized total return since inception to an impressive +10.0% (in market price and NAV terms), outstripping broad-based Indian ETF comparables like the iShares MSCI India ETF (INDA). Relative to the rest of emerging Asia as well, INCO's near and long-term outperformance through the cycles stands out.

Columbia Threadneedle

Like most other Indian funds, INCO's distribution won't appeal to income investors. The trailing yield stands at <1%, though the fund does boost overall distributions by periodically realizing capital gains. Another contentious area is INCO's ever-increasing valuation – last quarter's re-rating has driven INCO's earnings multiple to 44.7x (vs. ~40x prior), well above MSCI India. While current valuation levels can still probably be justified by INCO's portfolio companies' double-digit % earnings growth runways (and investors' willingness to underwrite that growth) and consistent low double-digit % ROEs, being opportunistic here seems sensible as well.

Columbia Threadneedle

Reviewing the Indian Consumer Sector's Structural Tailwinds

As mentioned above, the elevated valuations of the Indian consumer large caps, particularly on the staples side, is an issue. Hence, investors need to be very comfortable underwriting a double-digit % earnings growth runway for Indian staples over the mid-term. And given operating margins are already quite high for blue-chip names like Nestle India and Hindustan Unilever at >20%, revenue growth is key. The good news is that the sector isn't short of structural growth drivers - beyond population growth (India is already the most populous nation), there remains ample upside from category share gains vs. unorganized smaller players as these franchises expand their networks across the country. Alongside incremental revenue streams from adjacencies and new categories, the growth optionality for INCO's staples names is significant.

BBC

While the discretionary side trades at lower multiples vs. staples, the growth potential here is perhaps even greater over the mid to long term. India has always been a consumption-focused economy (the key driver of India's GDP is private consumption), so the expanding middle-class theme should translate even more strongly to earnings compared to the likes of China (<40% of GDP from consumption). Given India also remains at a very early phase of its urbanization process (note most of the population resides in rural areas), with discretionary spending still a small % of household budgets, the growth potential for aspirational goods and services (off a very low base) is massive. Like with staples, playing this theme via the large caps makes the most sense to me, given their superior distribution capabilities and share gain potential vs. the unorganized sector.

Economic Times

India's Consumption Growth Story is Still Worth the (Higher) Entry Price

With China currently mired in a protracted slowdown, India has rightly returned to investors' radars over the last quarter. Momentum is clearly on India's side, as highlighted by the latest PMI data (strongly expansionary for manufacturing and services vs contractionary in China). And over the next decade, the combination of India's longer runway (its fast-growing GDP per capita still trails China's by a long margin) and 'demographic dividend' should underpin structurally higher growth rates. By sector, consumption, the main contributor to Indian GDP, presents the most compelling way to gain exposure, in my view. Not only because of its growth potential, underpinned by an increasingly affluent middle class but also for its insulation from external volatility. At current levels, INCO's 30-stock consumer portfolio is admittedly pricey, but investors willing to underwrite a double-digit % earnings growth path will still find a lot to like here.

from "price" - Google News https://ift.tt/32oCzlM

via IFTTT

No comments:

Post a Comment