slobo/iStock via Getty Images

The Telecom Investment Thesis Remains Robust - Thanks To VZ's Price Hikes

We previously covered Verizon Communications Inc. (NYSE:VZ) in early July 2023, discussing the impact of the Amazon (AMZN) rumors and Wall Street Journal's lead-lined cable expose, triggering the drastic plunge of its stock prices to 2010 lows.

With market analysts expecting the rectification work to total nearly $60B, the telecom faced great uncertainties, especially worsened by its immense debts.

Then again, we believed that the steep correction presented great opportunities then, allowing income investors to DCA and take advantage of VZ's expanded forward yields.

Recently, VZ reported underwhelming FQ2'23 revenues of $32.6B (-1% QoQ/ -3.4% YoY), well balanced by the expanding gross margins of 60.8% (+1.8 points QoQ/ +3.5 YoY). This is compared to its FY2019 levels of 58.5% and FY2022 levels of 56.8%, thanks to the higher premium mix.

The improvement is a similar cadence we have observed with its telecom peers, such as AT&T (T) at 59.1% (+2.4 QoQ/ +2 YoY) and T-Mobile (TMUS) at 62.1% (+3.2 points QoQ/ +3.4 YoY) in FQ1'23. In addition, VZ is looking to further raise the monthly wireless home internet prices by $10 for new customers and grandfathered mobile plans by up to $5 in H2'23.

Interestingly, despite the hiked prices since 2022, VZ's consolidated postpaid phone churn in the Mobility segment has been moderate at 0.83% (-0.07 point QoQ/ +0.02 YoY) in the latest quarter, against the FY2019 averages of 1.09%. Its total net adds are still decent at +8K in FQ2'23 as well, compared to -127K in FQ1'23 and +12K in FQ2'22.

The star of the show is naturally the telecom's Broadband segment, with net additions remaining stellar at 418K (-4.3% QoQ/ +55.9% YoY), contributing to its expanded consumer wireless postpaid ARPA of $131.83 (+1.3% QoQ/ +6.1% YoY), thanks to the raised prices.

With the Consumer segment commanding the bulk of VZ's adj EBITDA at an annualized sum of $42.4B (+2.9% QoQ/ +1.9% YoY) or the equivalent of 88.3% (+1.8 points QoQ/ +1 YoY) of its FQ2'23 profitability, we think it makes sense that the management has opted for hiking prices to help boost its margins to 43.1% (+1.6 points QoQ/ +2.6 YoY).

Then again, this development is negated by the telecom's accelerating operating expenses of $12.61B (+6.7% QoQ/ +8.7% YoY), thanks to the increased marketing costs (by +10.1% QoQ/+13.3% YoY) related to myPlan. This naturally impacts its margins to 22.1% (-1 points QoQ/ -0.9 YoY) in the latest quarter.

Perhaps this is why the VZ management has guided FY2023 adj EBITDA of $47.75B (inline YoY), implying margins of 35.3% (inline YoY), despite the wireless service revenue growth of 3.5% YoY at the midpoint.

Combined with the elevated interest rate environment, triggering the expansion in its annualized interest expenses to $5.12B (+6.6% QoQ/ +63.6% YoY), it is unsurprising that the management's FY2023 adj EPS guidance is underwhelming at $4.7 at the midpoint (-9.2% YoY).

Then again, there is a silver lining for now, since VZ reports expanding H1'23 Free Cash Flow generation of $8B (+11.1% YoY), thanks to the moderating capital expenditure of $10.1B (-3.7% YoY).

Assuming a similar cadence in H2'23, we may see the telecom record improved FY2023 FCF of $16B (+13.8% YoY), partly attributed to its moderating capital spending of $18.75B (-18.7% YoY) at the midpoint.

While the number is not as impressive as VZ's previous outlook of $21B (+49.4% YoY) in the Analyst Day, we are encouraged by these decent developments, since it suggests the safety of its dividend, with cash flow at approximately $10.96B for the fiscal year.

In addition, the Fed is bound to pivot sooner than later in our view, with the US CPI sustainably moderating to 3% by June 2023, compared to 9% a year ago. Market analysts already priced in a terminal target rate of 5.5%, implying one last rate hike in 2023.

Assuming so, we may see VZ's headwinds moderate from henceforth, since 27% of its debt portfolio is exposed to the variable interest rates. This cadence may allow its effective interest rate to peak at FQ1'23 levels of 4.6% (+0.9 points QoQ/ +1.2 YoY), while also normalizing its full year adj EPS by up to +$0.30 in FY2024.

In addition, things may accelerate by H2'23, with the management guiding for expanded ARPA from the newly launched myPlan in May 2023, potentially boosting its long-term margins as the macro headwinds abate.

So, Is VZ Stock A Buy, Sell, or Hold?

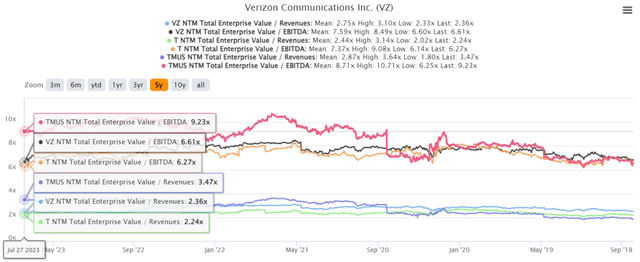

VZ 5Y EV/Revenue and EV/ EBITDA Valuations

S&P Capital IQ

For now, VZ continues to trade attractively at NTM EV/ EBITDA of 6.61x as well, moderated from its 1Y mean of 7.10x and 3Y mean of 7.07x. This is despite market analysts' projecting a stable EBITDA margin through FY2025.

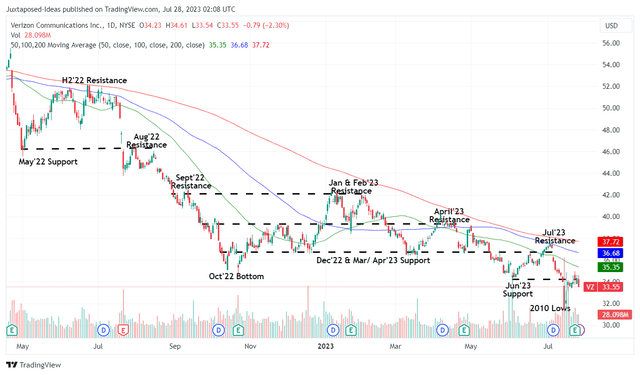

VZ 1Y Stock Price

Trading View

Largely due to the stock's oversold status, VZ has also risen moderately, reversing part of its steep losses thus far. For now, it appears that market sentiments have somewhat recovered, especially aided by its promising FQ2'23 performance and iterated FY2023 profitability.

As a result, we believe existing investors may be rest assured about the VZ investment thesis, since their incomes remain safe despite the stock's underwhelming performance against the SPY.

This led us to iterate our Buy rating on the VZ stock after earnings.

from "price" - Google News https://ift.tt/IiHB7NK

via IFTTT

No comments:

Post a Comment