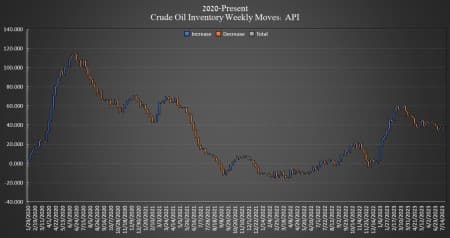

Crude oil inventories in the United States unexpectedly rose this week by 1.319 million barrels, the American Petroleum Institute (API) data showed on Tuesday after decreasing by 797,000 barrels in the week prior.

Analysts were expecting a draw of 1.969 million barrels in U.S. crude-oil inventories. The total number of barrels of crude oil gained so far this year is more than 35 million barrels, according to API data, although the net draw in crude inventories since April is just under 12 million barrels.

On Monday, the Department of Energy (DoE) reported no change for the second week in a row to the inventory held in the Strategic Petroleum Reserve (SPR) in the week ending July 21, with the SPR inventory still sitting at a 40-year low of 346.8 million barrels.

The price of WTI and Brent were both trading up on Tuesday in the run-up to the data release. By 3:00 p.m. EST, WTI was trading up 1.08%, at $79.59 per barrel—up just shy of $4 per barrel since last Tuesday, while Brent crude was trading up 1.05% at $83.61—also up nearly $4 this from this time last week.

Gasoline inventories saw another draw this week, falling by 1.043 million barrels after falling by 2.8 million barrels in the week prior, with inventories already 7% less than the five-year average. Distillate inventories rose by 1.614 million barrels, compared to the small 100,000 barrel draw in the week prior.

Crude oil production in the United States was stagnate at 12.3 million bpd for the week ending July 14, according to EIA data, still up just 100,000 bpd in the last six and a half months of this year.

Inventories at Cushing, Oklahoma, fell by another 2.34 million barrels, after falling by 3 million barrels in the previous week.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

from "price" - Google News https://ift.tt/HzulasB

via IFTTT

No comments:

Post a Comment