FG Trade Latin/E+ via Getty Images

Nautilus Inc. (NYSE:NLS) produces at-home fitness solutions, producing and marketing treadmills, ellipticals, uprights, and recumbents. It is the maker of Bowflex, Modern Movement, Nautilus (exited), Schwinn Fitness, and Universal equipment brands. The main source of their income is from direct-to-consumer sales and retail, with around 45% direct and 55% retail. In January 2021, their stock price peaked at a high of $30. Currently, the stock trades at $1.3, and it is still too risky for me.

Understanding the Market:

During quarantine, the company saw a sales surge as many consumers sought out alternatives to gyms, which Nautilus provides. Thus, net sales in Q4 decreased by 42.9% YoY, even when compared to pre-pandemic 2020 levels, normalized net sales were down by 19.2%. Overall, revenue still surpassed analysts' pessimistic estimates by over $10 million, though at a cost of margins.

In Q4, gross profit was down to 15.6% from 17.5% last year. This is due to the heavy discounting driven by the decision to exit the Nautilus-branded line of products. If Nautilus-branded products were excluded, gross profit would've been 20.3%.

Since recurring customers for this market is low, it is difficult for Nautilus to generate consistent income year over year. The demand for their products can vary widely year by year, and a lot of "advertisements" come from social trends.

Competition

Some notable competitors operating in the same industry include Life Fitness, ABEO, SuperFlex Fitness, and Balaz, all of which make gym equipment. The total market size for Nautilus is estimated at $10 billion globally. However, a slight slump is expected in the future as Nautilus saw lower demand than the pre-pandemic level.

A Next Move Strategy Consulting report published in December 2022 claims that the global market size for home equipment is expected to grow at only 2.8% CAGR until 2030. However, other independent reports estimate CAGR for the market to be as high as 9.3%. In Nautilus's report, the company saw "decreased demand" when compared to pre-pandemic levels.

The sales decline versus last year was driven primarily by the return to pre-pandemic demand. The net sales decrease compared to fiscal 2020 was due to decreased demand.

Nautilus is forecasted to generate $270-$300 million FY 2024, but the fierce competition forces the equipment market to have low margins, thus the company still guides a negative EBITDA.

JRNY

The latest endeavor for Nautilus is its JRNY app, a subscription-based app that tracks the user's workout and gives recommendations. The app has a free option and a subscription-based one for $20/month. The user base of JRNY increased significantly last year.

As of March 31, 2023, Members of JRNY®, the Company's personalized connected fitness platform, reached 508,000, representing approximately 56% growth versus the same quarter last year. Of these Members, 156,000 were Subscribers, representing approximately 41% growth over the same period last year.

While the member growth is exciting, it is terrible news that subscriber numbers did not increase at all compared to the previous report ending on December 31. In addition, the guidance only pointed to 625,000 members for next year, a 25% increase YoY shows that JRNY is slowing down.

business wire

In the case JRNY becomes a success, it would mean the company has found a way to generate reliable income at high-profit margins. However, given the results of last quarter, it seems unlikely that JRNY can reach a huge customer base.

Bulls Scenario

The obvious short-term bull case for the company is that demand once again goes to COVID levels. However, such an event seems improbable given that consumer spending is expected to decrease in the 2nd and 3rd quarters. In fact, I expect the retail segment to continue plummeting as stores adjust inventories.

A more realistic scenario is that Nautilus starts selling some of its brands. The selling of the Nautilus brand is expected to bring Nautilus $1.8 million in royalties this year.

Finally, given the sale of the Nautilus Brand, the Company expects royalty revenue to be $1.8 million

I see this as a positive as it means pure profits. As mentioned, Nautilus has many children-brands, so more passive profit will reduce operating costs and mitigate risks.

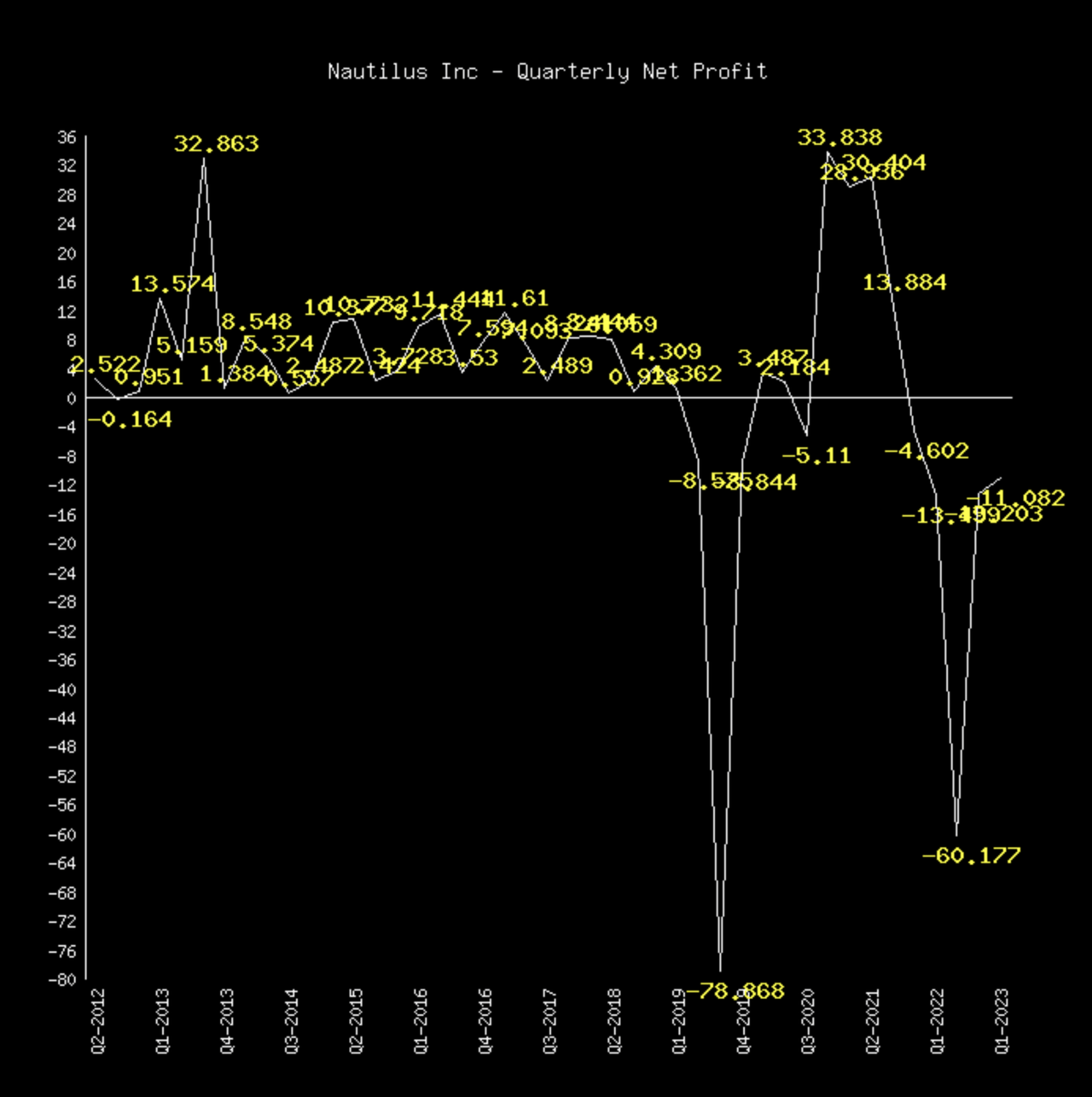

Nautilus earnings (netcials)

The fierce drop in earnings that occurred in 2019 may have foretold the fall of Nautilus, which was only temporarily saved by the quarantine. The fact is Nautilus product qualities are- fine, just average with little niches. In an environment where gym-culture is becoming the trend, private fitness equipment doesn't seem necessary anymore, and demand is slowing.

Bears Scenario

Last September, the board announced that it was exploring "strategic alternatives'', including the sale of the entire company. This makes a completely speculative guess on how much such a transaction would take place, or, if last comes to last, the liquidation value of the company. In this case, the company doesn't look too bad.

Nautilus has around $18 million in cash- the market cap is $39 million. The company also has $54 million in current debt and more in lease. For simplicity's sake, I will imagine all the properties are used as liens in the case of liquidation.

The company has trade receivable of $21.5 million, and trade payable of $29.3 million giving net liability of $7.8 million. Accrued liabilities of $15.5 million canceled with $19 million operating lease right-of-use assets will cancel out in my scenario.

This leaves $46.5 million in inventories, which I'll assume they can be auctioned off at 40% of the value. To get this liquidation value, I found liquidation auctions for these fitness products and liquidators selling liquidated fitness equipment to get a better idea of how much this equipment would go for. Auctioned items typically sell at 25-40% of the MSRP for items that do not include a quality check and 50% for items that do. Liquidators usually sell equipment at 50-70% of MSRP. Thus, I lowballed a little considering the urgency of such a large event, and averaged 40% for all items, with the assumption that they were found in great condition. All in all, this gives my over-simplified model a $30 million liquidation value ($0.85 per share), only a 25% downside from the current $40 million market cap.

Risks

The lack of demand for home-fitness equipment is my biggest worry about the company. I liked the board's decision to aggressively get rid of inventory, decreasing the amount by more than half compared to a year ago. However, selling at a discount will hurt its already-small margins, and hurt its balances. On the bright side, the company will most likely outperform consensus estimates, as the company forecast $270-300 million for FY 2024 while estimates range from $244-285 million. Investors should keep a close eye on how the company decides to deal with diminishing demands, and achieving positive cash flow will be crucial for a higher valuation. In the near term, I don't see anything Nautilus can do to increase demand. This year, they're expected to report negative earnings and there's no turnaround in sight.

Conclusion

Even as Nautilus trades at low prices compared to its highs, I still think the company is unlikely to experience a turnaround. However, the company is already quite cheap so I wouldn't call it a sell either. I would even consider buying if the price goes below $0.85, which I believe is near liquidation value.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

from "price" - Google News https://ift.tt/EJVs34o

via IFTTT

No comments:

Post a Comment