RiverNorthPhotography

Thesis

Shares of T. Rowe Price (NASDAQ:TROW) have taken a beating, but we view the severity of the decline as unwarranted. The macro environment has caused a decline in AUM, but once capital markets improve T. Rowe Price will again be able to show the positive operating leverage inherent in their model. The company has a strong track record and a pristine balance sheet. We view the valuation as compelling at these levels and believe that the risk/reward in T. Rowe Price is favorable.

Decline in AUM

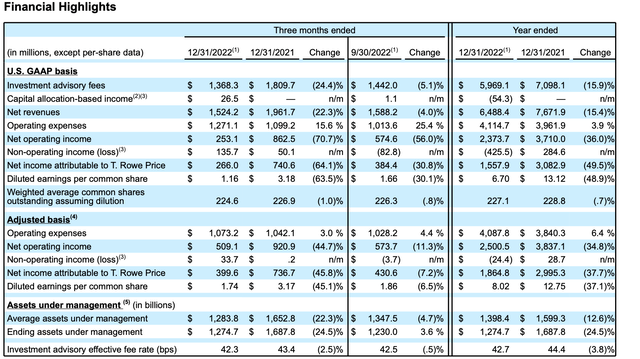

Over the course of 2022 T. Rowe Price endured a dramatic decline in AUM. They ended 2021 with $1687.8 billion of AUM and ended 2022 with $1274.7 billion of AUM. This figure has since improved to $1,349 billion of AUM as of the end of January. Given how the market performed in 2022 it is no surprise that their AUM declined substantially over that timeframe. Unfortunately for investors, the nature of T. Rowe's business means that a percentage decline in AUM is accompanied by an even larger percentage decline in operating income.

For the full year 2022 a 24.5% decline in AUM was accompanied by a 70.7% decline in operating income (both figures year over year). Their business model is a double edged sword, when equity markets are increasing they take advantage of massive operating leverage and grow earnings at a much higher rate than AUM growth. Consequently, that same operating leverage amplifies the decline in earnings when capital markets deteriorate.

Q4 and FY 2022 Financial Highlights (T. Rowe Price's Q4 Earnings Presentation)

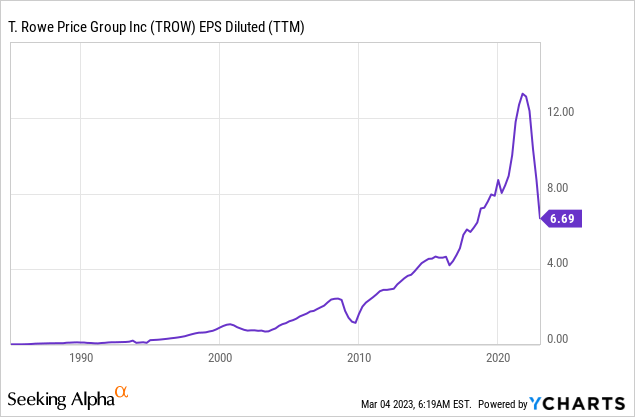

For T. Rowe Price to return to their prior highs capital markets need to meaningfully rebound and the company's management needs to be able to execute. Fortunately for investors, T. Rowe Price has a strong track record of growing earnings and dividends over the long-term and should be able to continue to do so once the markets rebound.

Strong Track Record

T. Rowe Price has done well to grow earnings over their time as a public company, with some notable exceptions. During those years their earnings took a sizable hit but were able to recover over time. Management will likely be able to do the same after this latest earnings decline, although there is a lot that is out of their control.

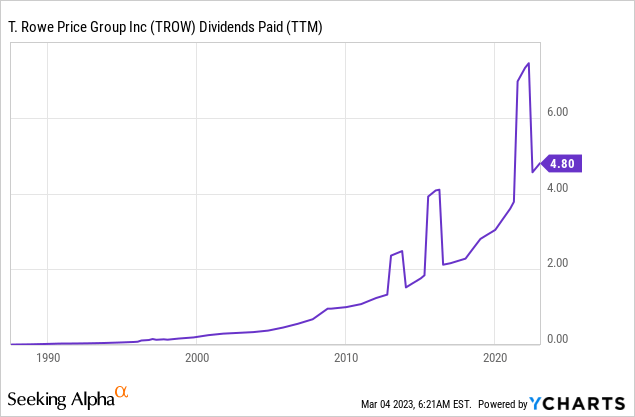

T. Rowe has consistently raised their dividends, giving income oriented investors a reason to own the stock. Even for investors that are not income oriented the dividend yield is nice because it provides a modest return while they wait for capital markets to rebound.

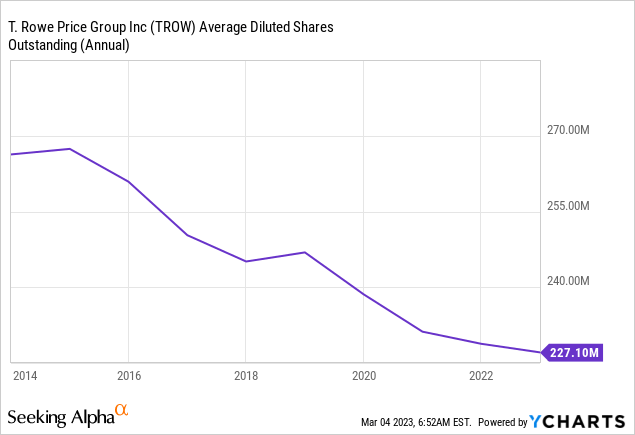

The company has been an active buyer of their own stock over the past few years. Management's commitment to reducing shares outstanding is refreshing in an era of rampant dilution through SBC and acquisitions.

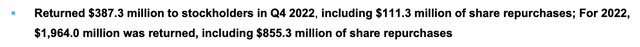

The combination of growing dividends and stock buybacks shows that management is shareholder friendly. Fortunately for investors, these capital returns have been funded entirely though earnings growth and T. Rowe's balance sheet remains in pristine condition.

Capital Returns (T. Rowe Price's Q4 Earnings Presentation)

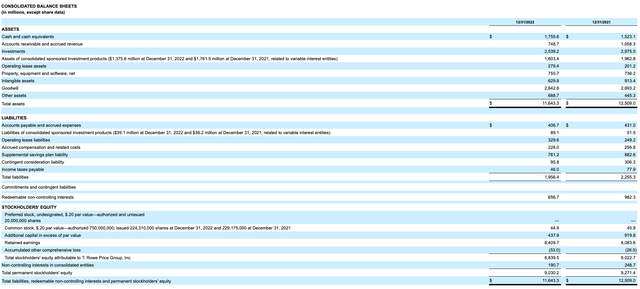

Pristine Balance Sheet

T. Rowe Price has zero debt on their balance sheet. Not only that, they almost have enough cash and cash equivalents to completely cover their total liabilities. This type of balance sheet is the pinnacle of financial health, and shows that T. Rowe Price has the ability to weather the storm. The state of their balance sheet also shows that unlike many companies with robust capital return plans, T. Rowe Price was able to fund theirs entirely through operating earnings. This reduces the likelihood of a sustained dividend cut in the future, although short-term cuts in the dividend may occur due to the nature of their business and exposure to market cycles.

Balance Sheet (T. Rowe Price's Q4 Earnings Report)

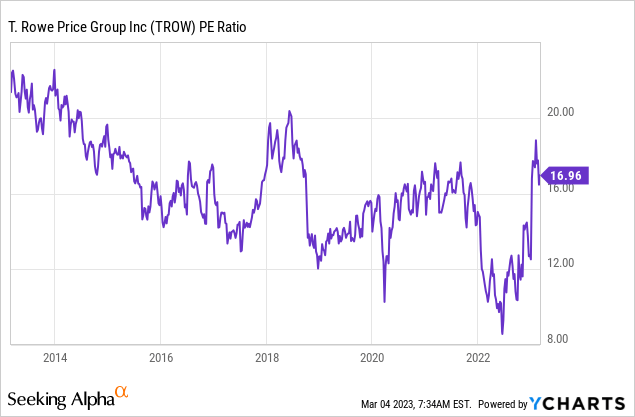

Compelling Valuation

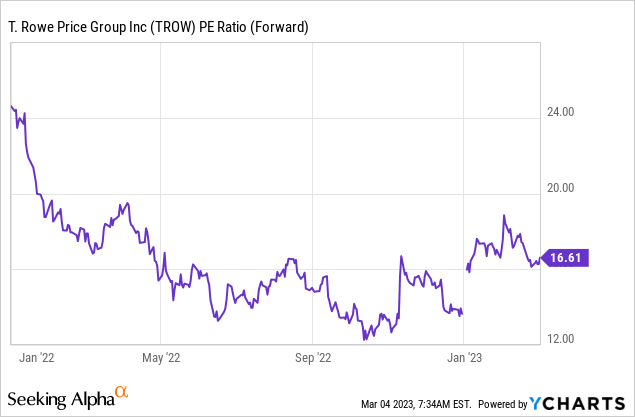

T. Rowe Price is trading around their normal P/E multiple, however this still represents an attractive buy level. This is because of how their business operates, investors want to be buying shares when the market has taken a beating and investors have exited the stock in droves. Once capital markets return to their prior highs T. Rowe's earnings will increase at a much higher rate than their AUM growth. If the stock maintains its long-term P/E ratio shares will move higher to compensate for that earnings growth. When buying shares of T. Rowe Price investors are essentially getting leveraged exposure to the market as a whole while getting paid a nice yield while they wait.

On a forward basis, T. Rowe is not expected to show much earnings growth. If the company is able to outperform expectations the stock will likely move higher as a result.

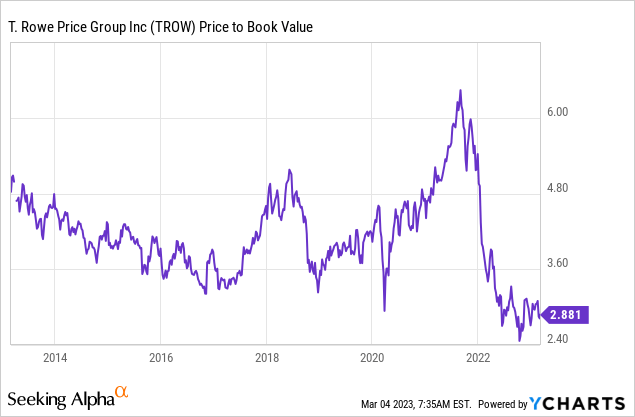

T. Rowe Price is trading at the lower end of their average P/B ratio. This gives investors some amount of margin of safety. There would be other asset managers eager to acquire T. Rowe if the stock dropped much further, especially considering their clean balance sheet and high quality management.

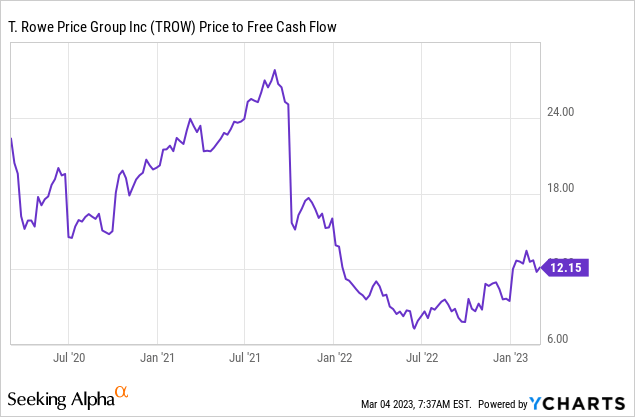

T. Rowe Price looks especially attractive on a price to free cash flow basis. Given the company doesn't have any debt, all of this free cash flow is available to equity holders. This significantly increases the present value of the firm and investors can take comfort in knowing that this free cash flow is somewhat safe and has a large amount of potential upside.

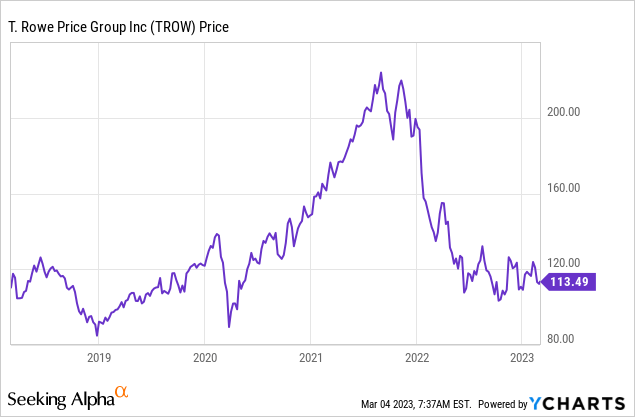

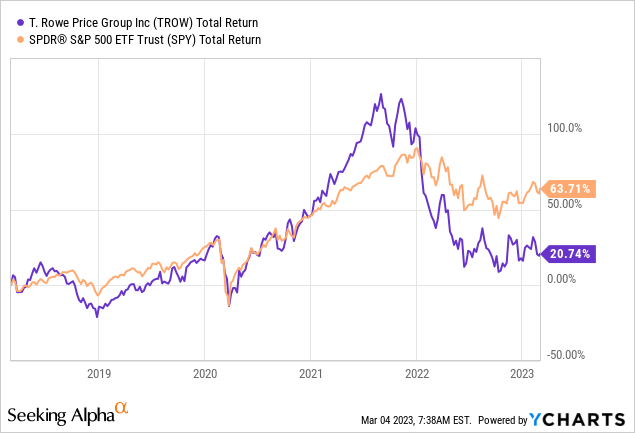

Price Action

Shares in T. Rowe Price have seen a dramatic decline from their all time highs. This decline can be attribute to the double edged sword of their business model and investors being in a risk-off mood. We believe that the severity of the selloff is overdone and that investors can use this decline as a buying opportunity.

T. Rowe Price has trailed the S&P over the past five years which isn't great for their resume. That being said, the key with T. Rowe and most other asset managers is to buy them after markets have declined and their stocks have been heavily punished and de-risked. The selloffs are often overdone due to investors fearing the worst, and once markets stabilize so do the earnings of asset managers. The earnings beta of asset managers often makes selloffs buying opportunities so long as investors are willing to let the shares go once markets begin to overheat again and don't try to time to absolute top or bottom.

Risks

A risk to this bullish thesis is the possibility that passive investing continues to grow in popularity and begins to eat into demand for T. Rowe's active management strategies. This is certainly one of the largest risks to the bull case, but so far T. Rowe's management has been able to continually meet client needs and grow AUM over the long-term despite passive strategies counting to grow in popularity over the past few decades.

Another risk to this bullish thesis is the possibility for capital markets to take another leg lower and stay depressed for a long time. In such a scenario T. Rowe Price's stock would likely decline further and their earnings could even go negative. That being said, the strength of their balance sheet means that long-term investors will probably be fine even in a worst-case scenario.

We like the overall risk/reward at these levels and see a compelling reason to buy shares of T. Rowe Price as long as investors are generally bullish on the market over the next three or so years. If an investor believes we are going to enter a prolonged period of sideways action or continue to trend lower, they should probably avoid buying T. Rowe Price or any other asset manager.

Key Takeaway

We believe the selloff in shares of T. Rowe Price is overdone and view the valuation as being attractive enough for long-term investors to build a position. Management is committed to shareholder returns and investors will get a nice dividend yield while they wait for capital markets to rebound.

from "price" - Google News https://ift.tt/fEwZGs4

via IFTTT

No comments:

Post a Comment