Anchiy

The second-hand clothes marketplace ThredUp Inc. (NASDAQ:TDUP) is up 15.9% as I write today, giving me confirmation of the Buy rating I put on it when I wrote this article this morning. But let us rewind. It has now seen 42.4% gains in 2023 so far, up from an already impressive price rise of 29.4% when I checked last. This is a sharp comeback from the slump it started seeing in early February. In fact, over the past month, it is still down by almost 10%.

Fast growing market

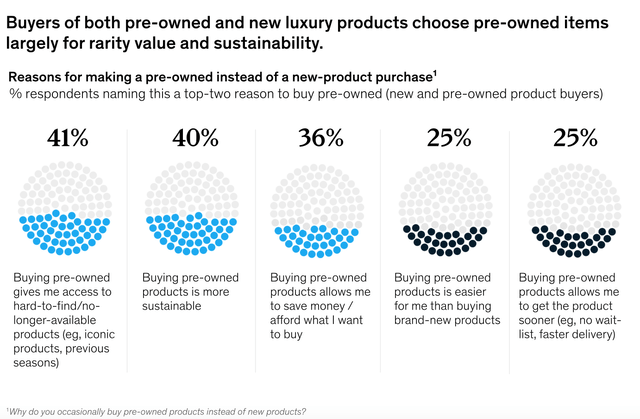

Founded in 2009, the California-based ThredUp Inc. functions in the fast-growing resale market. McKinsey and Co's research put the industry size at USD $25-30 billion as of 2020, with 10-15% annual growth expected over the next decade, as consumers are driven to pre-loved fashion for reasons like finding unique items, sustainability consciousness, and money-saving (see chart below). Sellers, on the other hand, typically want to change up their wardrobe and unburden their closets, while also making some money in the process.

ThredUp is already an established presence in this space. According to a Vogue Business report, "The RealReal, ThredUp, eBay and Vinted hold a 25-30 per cent market share, and are driving much of the sector's growth."

Source: McKinsey & Co

With this as the starting point, there was much investor interest in TDUP stock when it had its IPO in early 2021. Its share price rose by 43% on the first trading day. The rest of its stock story does not look quite as good, however. Especially since the stock markets started weakening in late 2021, the stock has largely declined. At USD $1.68 as I write, it is trading at a fraction of its listing price of USD $14.

Here I take a closer look at what has changed since to figure out what's next for ThredUp Inc. stock.

Slowing down visible

Signs of slowing down are certainly visible for the company. For the third quarter of 2022 (Q3 2022), it reported a 7% year-on-year (YoY) revenue growth. This is the slowest revenue growth in any quarter since it got listed in March 2021. That its average growth over the past seven quarters has been at 30% puts this into perspective. Even in absolute terms, revenues were the lowest in four quarters at USD $68 million.

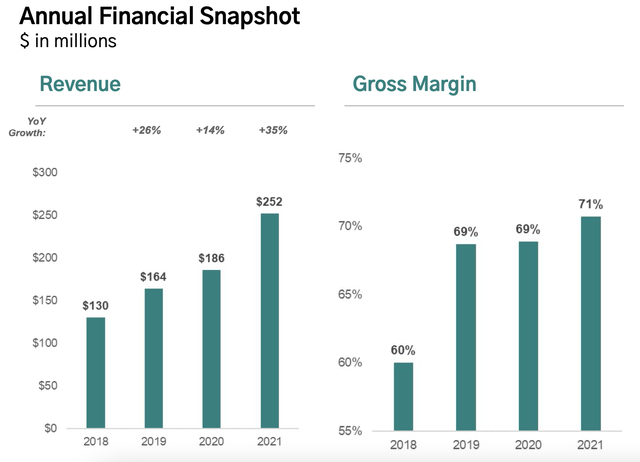

Its gross profits also declined, by 3% YoY, for the first time after seeing double-digit growth for the past six quarters on account of a slowing down in revenue growth, but also because the cost of revenues has risen fast in the past year. That said, its gross profit margin still remains quite strong at 65.5%, even if it is down from 72.8% in Q3 2021. The figure below gives an annual financial snapshot, providing a perspective of how the company has performed in the past.

Source: ThredUp

The real challenge lies ahead

But the real challenge for ThredUp Inc. will be its Q4 2022 numbers, expected 6 March post-market. It expects revenue to come in between USD $62-64 million. This will make it the lowest revenue level in five quarters. It will also be the first time it clocks a revenue decline, and not by a small number, but by 13.6% YoY, if it comes in at the average of the range provided. That it is still expected to show an 11.2% growth for the full year 2022 is some consolation though, even if it is the slowest growth since 2019, the year since which full-year numbers are available. The slowdown in sales is expected to continue though. Analysts expect its 2023 growth to come in at 7.8%.

Low market multiples

The company's unique selling point as far as its financials go, has been its sales growth, considering that it is loss-making. Its good balance sheet helps, too, but if I were to consider buying the stock, the income statement would be my focus. In keeping with that, let us consider ThredUp Inc.'s market multiples, specifically its price-to-sales (P/S) ratio. Its trailing twelve months [TTM] P/S is at 0.52x, which is quite a bit below 0.9x for the consumer discretionary sector. This is despite the fact that its TTM revenue growth at 30.4% is significantly higher than that for the sector at 10.9%. This, to me, suggests that the price could have fallen more than is warranted. If it were to trade at the sector's P/S, the TDUP price would be double where it is now.

At the same time, I think it is also a good idea to take a look at TheRealReal, Inc. (REAL), its closest peer and the marketplace for pre-loved luxury fashion, trading at an even lower P/S of 0.22. This is despite its much stronger TTM revenue growth, compared to both TDUP and the sector, of 43.9%. It is, however, showing signs of stress, as it is undertaking layoffs to cut costs, though that should also be seen in the light of its recent changes at the top. It's hardly alone in cost-cutting though. I recently wrote about Vera Bradley, Inc. (VRA), another consumer discretionary stock that is cutting costs and its share price continues to rise.

Buyout price

To me, this raises the question: why are fashion resale marketplace stocks being left behind? One way to look at is by considering the outcome for Poshmark, another peer which was acquired by the Korean NAVER Corporation (OTCPK:NHNCF) late last year.

Its stock, which was trading at around USD $10 at the time, jumped on the announcement, as the sale price of USD $17.9 was in excess of the then price. However, it was still significantly lower than its listing price of USD $42 in early 2021. While valuations at the sale are a function of the state of the markets at the time, I think there is also an indication here that these stocks were probably valued a bit too high when they debuted on the stock markets.

Seen in that context, it appears doubtful if ThredUp can go back up to its price at the IPO. But it is worth pointing out that the company's enterprise value-to-sales (EV/S) at 0.4x is nowhere close to Poshmark's at the time of sale at 2.4x. In fact, it is also lower than that for TheRealReal at 0.74x and that for the consumer discretionary sector at 1.22x. This indicates that, even if the company were a buyout candidate, it will likely sell at a much higher price.

What next?

Based on this assessment, there is very little downside left to ThredUp Inc., whichever way I look at it. It is in a fast-growing market, so over time, I reckon it could do better. But even if ThredUp Inc. gets sold out, there's a strong likelihood of the price rising from current levels at the time. I would rate it a Buy.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

from "price" - Google News https://ift.tt/qfIhe0D

via IFTTT

No comments:

Post a Comment