Natural gas futures seesawed in a narrow range of gains and losses much of Friday before ultimately finishing in the red for the third time in four sessions. Following a 45.2-cent sell-off in the previous session, February Nymex gas futures on Friday lost 1.0 cent day/day and settled at $3.710/MMBtu. The March contract shed 3.4 cents to $3.392.

At A Glance:

- Prompt month sheds a penny

- Bearish weather forecasts persist

- Production back up to 101 Bcf/d

Following back-to-back declines, NGI’s Spot Gas National Avg. ticked up 10.5 cents to $5.135 on Friday. Gains in the West offset continued losses across most other regions.

NatGasWeather said the outlook is tenuous for prices. The firm said Friday that both the American and European weather models, which had already pointed to the warmest January in more than a decade, trended even more bearish in terms of degree day totals heading into the final trading session of the week.

National heating degree days for the 15-day projection period were down more than 110 compared to historic norms, equating to nearly 180 Bcf less demand, according to the firm.

“What also makes the coming pattern emphatically bearish is recent weather data maintains the frigid cold pool remaining locked over northern Canada through Jan. 20, suggesting colder air shouldn’t be expected into the U.S. until near or after Jan. 25,” NatGasWeather added.

Additionally, production hovered around 101 Bcf/d on Friday – up from December lows below 90 Bcf/d. Output had briefly declined amid wellhead freeze-offs following a late 2022 Arctic blast.

The prompt month hovered near an 18-month intraday low early Friday and finished the week down 17% from the previous week’s close.

Robert Yawger, director of energy futures at Mizuho Securities USA, said slumping natural gas futures had dragged down the Bloomberg Commodity Index during the past week. The index hit an 11-month low intraday Friday. Natural gas, the “worst performing” component, “is killing the index,” Yawger said.

The weakness in Nymex gas futures to kick off the new year reflected in part declining demand in Europe, where benchmark prices early this year hit the lowest level since 2021. Above-average temperatures spanned much of the continent early in January, and forecasts called for relatively modest heating demand through the week ahead.

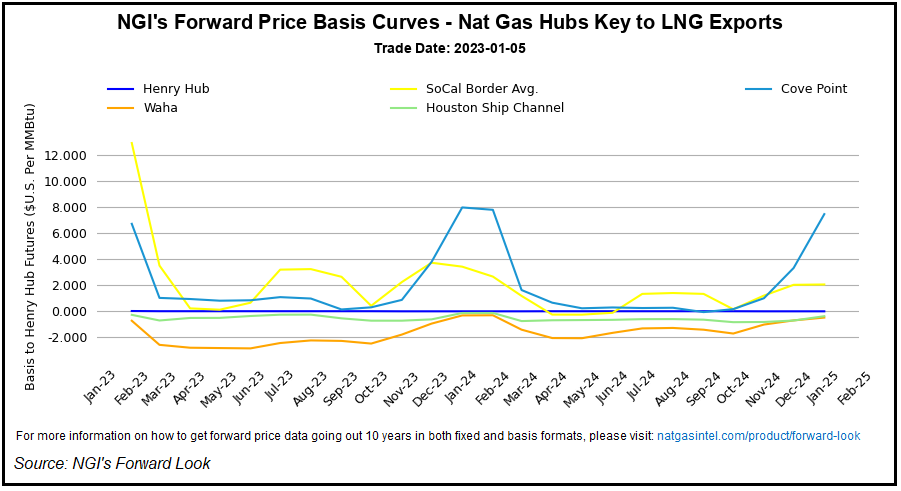

Mild conditions in Europe could eat into demand for U.S. exports of LNG – a pillar of strength undergirding U.S. prices throughout 2022.

Even if demand for American liquefied natural gas holds steady, doubts simmered Friday whether a key export facility, out of commission since a fire last June, would relaunch in the second half of January as planned. Following multiple delays late in 2022, officials at Freeport LNG in Texas maintain they expect to restart later this month and steadily ramp up capacity to more than 2.0 Bcf/d.

However, analysts are dubious. Case in point on Friday: Washington consulting firm Rapidan Energy Group said in a report that Freeport may remain offline for “several more months” because of federal regulators’ demands for “extensive personnel training” to guard against future safety mishaps. Bloomberg first reported the news.

Anemic Storage Pulls Ahead?

Even a massive storage withdrawal – the second straight – did little to galvanize bulls during the week.

The U.S. Energy Information Administration (EIA) on Thursday reported a withdrawal of 221 Bcf natural gas from underground storage for the week ended Dec. 30. That marked the 33rd largest draw on record and followed a 213 Bcf pull the week before, analysts at The Schork Report noted.

The latest pull also far exceeded the five-year average of 98 Bcf, and it dropped inventories to 2,891 Bcf, well below the year-earlier level of 3,199 Bcf and the five-year average of 3,099 Bcf.

But the Schork analysts said markets looked past the robust declines of late December and focused instead on expectations for weak withdrawals in January because of the shift to benign weather that is forecast to result in “a dearth of heating demand.”

Tudor, Pickering, Holt & Co. analysts said after the EIA print that the market is about 5 Bcf/d oversupplied on a weather-adjusted basis. With total degree days tracking well below the 10-year average, they said, poor demand “remains the dominant driver” for natural gas prices.

Looking to the next EIA print, preliminary estimates for the week ended Jan. 6 submitted to Reuters landed at a median decline of 31 Bcf. For the comparable week last year, EIA posted a decrease of 179 Bcf, while the five-year average is 151 Bcf.

“Some analysts expect next week’s EIA report could print a rare winter build,” NatGasWeather said, “although our data currently sees it as a weak draw.” The next three EIA reports are likely to show about 250 Bcf lower natural gas consumption compared to averages, “thereby flipping deficits to surpluses, with the potential that deficits increase further if colder weather maps don’t arrive for the last 10 days of January.”

Cash Prices Finish Up

Spot gas prices pushed ahead Friday, led higher by messy weather and chilly air in the West that offset mild temperatures and waning demand across most of the Lower 48.

SoCal Citygate gained 75.5 cents day/day to average $19.400, while PG&E Citygate advanced 49.5 cents to $17.165 and SoCal Border Avg. picked up 54.0 cents to $17.905.

Elsewhere, however, prices were relatively weak. Chicago Citygate, for one, fell 13.0 cents to $3.250, and Henry Hub dropped 34.0 cents to $3.415.

National Weather Service (NWS) forecasts showed above-average temperatures across much of the Midwest, South and East over the coming week. For the third week of January, NWS data pointed to average temperatures – or above – across most of the United States, indicating another stretch of modest demand lies ahead.

The West Coast remains a wildcard following a rash of severe weather in recent days. The region could see an abundance of precipitation – and a continuation of flooding problems following recent rains – with the potential for cooling winds.

Severe storms “unleashed fierce back-to-back blows to California at the end of 2022 and the start of 2023,” AccuWeather meteorologist Alex Sosnowski noted. He said “a series of storms lining up across the Pacific Ocean will continue to aim for the Golden State with rounds of heavy rain and mountain snow” through mid-month. One storm early in the coming week is expected to be followed by another the following week, potentially slamming already drenched areas of northern and southern California.

“The impacts from these upcoming big storms will be to unleash new rounds of torrential rain, flash flooding and mudslides, as well as tremendous, road-clogging snow and avalanche danger over the Sierra Nevada,” Sosnowski said. “The dangers of flooding and mudslides will increase with each passing storm.”

from "price" - Google News https://ift.tt/NYMsvkj

via IFTTT

No comments:

Post a Comment