The true cost of burning fossil fuels is not reflected in their market price. People often compare the monetary price of fossil fuels to low-carbon alternatives such as renewables or nuclear energy. But these comparisons do not capture each option’s social impact, even in a purely economic sense.

Burning fossil fuels drives climate change. The impacts of climate change come at a cost – these impacts are already happening.

They also cause local air pollution, which kills millions every year and has negative health impacts for many more.

One way to address this is to put a price on carbon. The purpose of setting a carbon price is to capture some of these external costs in the market.

My colleague, Max Roser, wrote a detailed case for a carbon price here.

Putting a price on carbon achieves a couple of things. First, it makes more polluting fuels, products, and services more expensive. Burning coal becomes much more expensive than using solar energy. Beef gets more expensive relative to tofu or meat alternatives. It makes the ‘cleaner’ option less expensive.

Second, it means it’s those who emit greenhouse gases that pay for it.

There are a few policies through which countries can put a price on carbon:

- Carbon tax: this is a levy that is applied to the production of greenhouse gas emissions directly or fuels that emit these gases when they’re burned. This means goods and services which emit more greenhouse gases in their production will have a higher tax.

- Emissions trading system: this is sometimes called a ‘cap and trade’ system. Here, the carbon price changes over time. A maximum level of pollution (a ‘cap’) is defined and manufacturers need licenses to emit greenhouse gases. How expensive these licenses are is determined by a trading system. The price of a license increases as emissions approach the cap.

Many countries have adopted carbon pricing instruments.

In this article, we provide an overview of which countries have them, and how the price of carbon is changing over time. The underlying data – from the World Carbon Pricing Dataset – is updated annually.1 It is assembled by Geoffroy Dolphin. We will keep the data in this article updated.

Which countries have a carbon tax?

The first chart shows which countries have implemented a carbon tax.

It’s often the case that only specific sectors, or specific fuels, in a given country are subject to a carbon tax. For example, heavy industry or household electricity might have a carbon tax, but road transport might not.

A country is coded as having a carbon tax if any of its sectors have one. This means the country does not necessarily have an economy-wide tax in place.

One final note: the World Carbon Pricing Database only looks at taxes applied to carbon dioxide (CO2) emissions. It does not consider taxes on non-CO2 greenhouse gases, such as methane or nitrous oxide.

What is the level of carbon taxes?

Having a carbon tax does not guarantee that it will be effective. The level of carbon tax rates matters. It needs to be sufficiently expensive to de-incentivize carbon-emitting activities, and incentivize low-carbon ones.

In the chart, we see the carbon price in countries that have implemented a tax.

Since carbon prices might vary from sector to sector, or some sectors will have a carbon price while others won’t, the authors calculate an ‘emissions-weighted’ carbon price. This price is weighted according to each sector’s contribution to a country’s CO2 emissions.

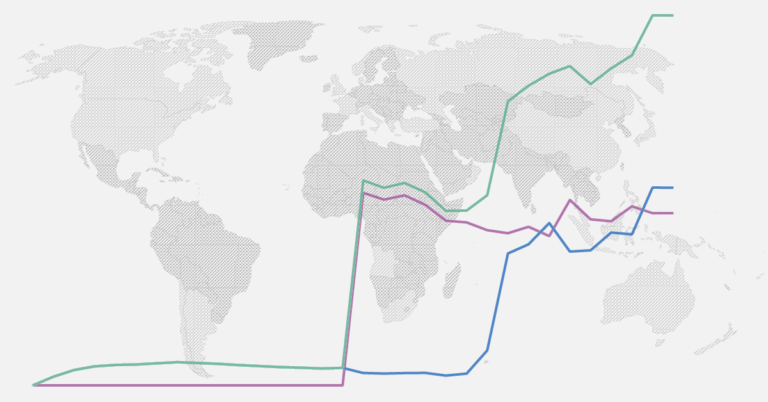

Which countries have a carbon emissions trading system?

The alternative to a carbon tax is a ‘cap and trade’ system. This is where the number of emission allowances/licenses, or the amount that a country or sector can emit, is fixed. Companies and sectors within the economy can then buy and sell carbon credits. This supply and demand determine the price of carbon in the marketplace.

The most well-known ‘cap and trade’ system is the European Union’s Emissions Trading System (EU ETS). It was first introduced in 2005.

But a number of other countries have implemented one at the national or sub-national level.

In the chart, we see which countries have implemented an emissions trading system. Again, a country is coded as having a system if at least one sector is covered by one.

What is the carbon price in emissions trading systems?

The supply and demand for carbon credits within an economy determines the carbon price. If the amount of available credits is low compared to demand, then the price will be higher. If there are many available credits then the price will be low, and companies will not be incentivized to reduce their emissions. This means the carbon price changes over time.

In the map, we see the carbon price in emissions trading systems across the world. Again, if the price varies by sector, these prices are weighted by each sector’s contribution to the country’s CO2 emissions.

How much of the world’s CO2 emissions are covered by a carbon tax or emissions trading system?

If we want the climate cost of fuels and products to be reflected in their market price we would want a carbon pricing mechanism everywhere.

In 2020, around 12% of emissions were in countries or sectors that had a carbon tax. Just 6% were covered by a trading system. This means that, in total, a carbon price had to be paid on 18% of global emissions.

We see the share of global CO2 emissions that are covered by each in the chart. The map also shows the share of emissions in each country that are covered by either a carbon tax or emissions trading system.

This data is currently only shown to 2020. As of 2021, this coverage expanded dramatically – to 25% of global CO2 emissions – because China started its national emissions trading system. This will be reflected in the next update of this dataset.

Keep reading at Our World in Data

Acknowledgments

Many thanks to Geoffroy Dolphin and Felix Pretis for the provision of data from the World Carbon Pricing Database, and feedback on this work. Thanks also to Max Roser, Edouard Mathieu and Bastian Herre for editorial feedback on this article.

from "price" - Google News https://ift.tt/gQqA8um

via IFTTT

No comments:

Post a Comment