[unable to retrieve full-text content]

Australian Home Prices Rise for Second Straight Month in Sign of Market Stabilization Bloombergfrom "price" - Google News https://ift.tt/uB51Xr2

via IFTTT

[unable to retrieve full-text content]

Australian Home Prices Rise for Second Straight Month in Sign of Market Stabilization Bloomberg

Iran's parliament voted in an impeachment session on Sunday to remove the industry minister amid soaring prices as the Islamic Republic's economy reels under the pressure of international sanctions.

Reza Fatemi Amin failed to garner enough support in a vote of confidence that saw 162 MPs vote in favour of his removal and 102 against.

It was the second time he had faced such a vote in parliament over the same issues, after securing 182 votes in a November majority vote that meant he stayed in the post.

A major factor in the new impeachment was the rising price of domestically manufactured vehicles after foreign imports dried up because of sanctions over Iran's nuclear ambitions.

Last year the supreme leader, Ayatollah Ali Khamenei, who has the final say in major policies, criticised the high prices and low quality of home-made products including cars.

Sunday's vote came with the economy battered by Western sanctions, rampant inflation and record depreciation of the rial against the dollar since 2018 when then-president Donald Trump withdrew the US from a landmark nuclear deal with Tehran and reimposed biting sanctions.

Defending the minister ahead of the vote, President Ebrahim Raisi had urged "stability in the management of this ministry".

And Fatemi Amin himself argued: "The automobile industry is based on assembly and domestication, so it has problems with the ups and downs of sanctions."

But MP Lotfollah Siahkali accused the minister of reporting wrong numbers to the president about growth in the sector.

"If there is growth, why don't we see it in people's lives?" he asked, adding that the ministry should leave the auto industry to the private sector.

A simple majority in parliament is all that is required for such a vote to go through.

Parliament Speaker Mohammad Bagher Ghalibaf announced the results of the vote during a session broadcast live on state television.

Bitcoin approaches the end of April barely moving as BTC price offers little short-term clues on trajectory.

Collect this article as an NFT

Bitcoin (BTC) narrowed volatility on April 30 as the weekly and monthly candle closes loomed.

Data from Cointelegraph Markets Pro and TradingView tracked BTC/USD as it loitered just above $29,000 throughout the weekend.

After unsettled price action earlier in the week, Bitcoin returned to sideways trading, with markets witnessing an eerie calm despite the potential for volatility thanks to lower weekend liquidity.

As such, traders were hopeful that no unwelcome surprises would greet the candle closes.

Stablecoin Sunday for #Bitcoin today please pic.twitter.com/4qphyAOssT

— Crypto Tony (@CryptoTony__) April 30, 2023

“Nothing has changed,” popular trader Elizy summarized in part of recent Twitter analysis of the 3-day chart.

Elizy eyed a potential upside target of up to $32,500 in the event of a breakout, while the loss of a key trend line below spot price would be cause to “become really bearish.”

Fellow trader known as J focused on the monthly close, noting that BTC/USD now sat at a historically significant point based on behavior from throughout its current halving cycle.

“On the monthly, we can see Bitcoin has rallied into the 2021 lows, which is a major resistance + supply area,” he summarized.

As part of the longer-term roadmap, the largest cryptocurrency should see “Chop + slightly down during May - Sep/Oct,” J added, before performance picks up.

With little to work with on lower timeframes, others also resorted to examining strength on the weekly chart and higher.

Related: Bitcoin price holds $29K as US PCE data sparks 90% Fed rate hike bets

Among them was analyst Moustache, who noted support holding above key exponential moving averages (EMAs) in a manner similar to that which preceded major upside in previous years.

“Imagine being bearish on BTC even though it has been forming support ABOVE the EMA ribbon bands for several weeks. Good luck bears,” he commented.

Last week, Moustache argued that "smart money" had already built BTC positions and was now waiting for the real upside to kick in.

At current spot price of $29,267, Bitcoin would go some way to canceling out the prior weekly candle losses were it to close without last-minute volatility.

Magazine: Whatever happened to EOS? Community shoots for unlikely comeback

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

[unable to retrieve full-text content]

Sudan's Neighbors Pay the Price as Rival Forces Vie for Power Bloomberg

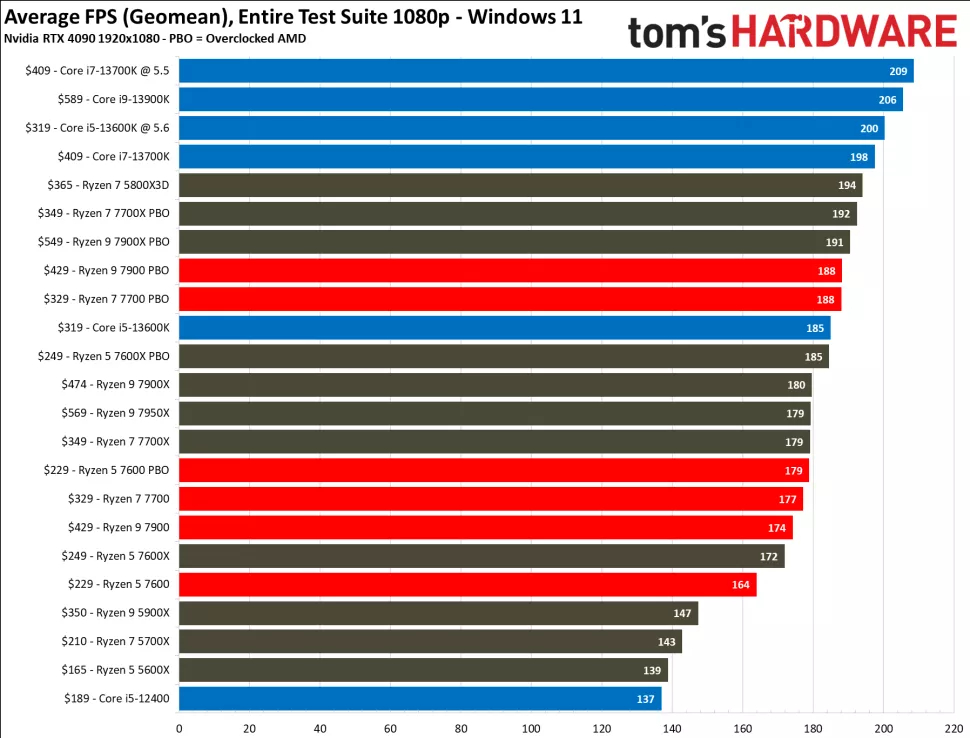

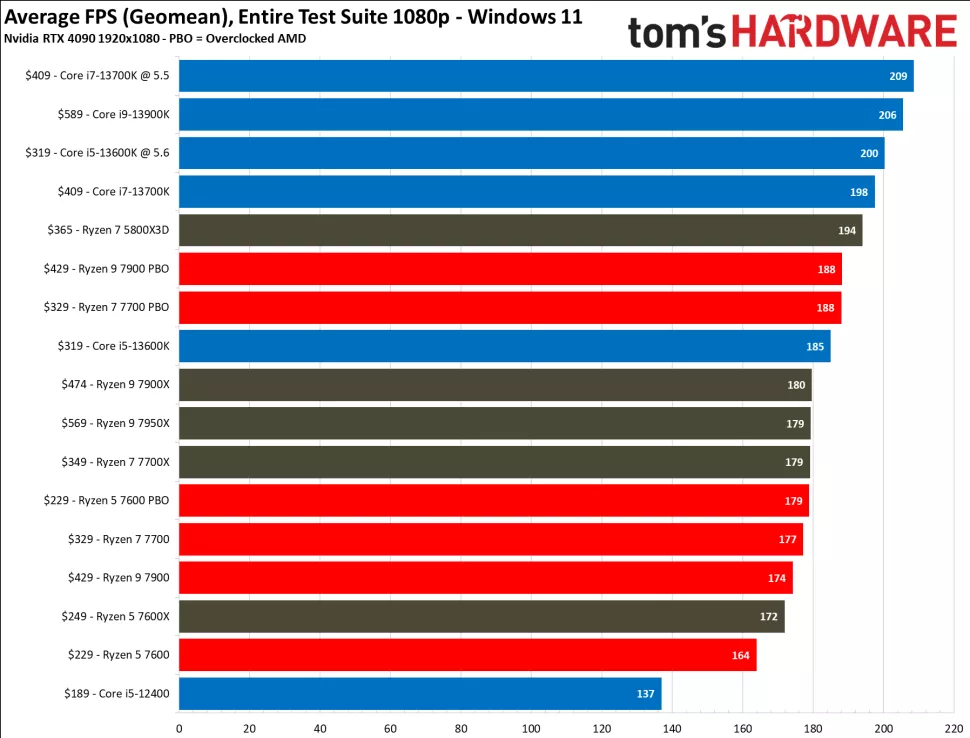

Today at eBay, you can find the AMD Ryzen 9 7900 for its lowest price to date. This processor debuted earlier this year and has dropped to $369 (opens in new tab)for the first time since launch. It’s usually priced around $429, so this discount saves users $60 off the going rate. This CPU is sold new by Antonline, an authorized AMD seller, and includes a full warranty.

The AMD Ryzen 9 7900 uses Zen 4 architecture and comes with integrated AMD Radeon graphics so a graphics card isn’t necessary to get off the ground with it—though we would definitely recommend one for gaming. We published our AMD Ryzen 9 7900 review when it was released, noting our appreciation for its performance in both single and multi-threaded use cases. It’s overclockable, as well, lending to notably high boost frequencies.

Users have 12 cores to take advantage of alongside 24 threads. It has a base speed of 3.7 GHz but can reach up to 5.4 GHz with max boost enabled. The AMD Ryzen 9 7900 supports up to 128 GB of DDR5 via two channels. This edition is unlocked for overclocking and uses AMD EXPO Memory Overclocking technology. Users also receive a Wraith Prism stock cooler.

To get a closer look at this deal, visit the official AMD Ryzen 9 7900 (opens in new tab) product listing over at Antonline’s eBay profile. As of writing, it’s not clear for how long this deal will be made available.

Ash Hill is a Freelance News and Features Writer at Tom's Hardware US. She manages the Pi projects of the month and much of our daily Raspberry Pi reporting.

Housing values will drop by double digits this year, one expert is predicting, as tighter lending requirements choke off demand.

“So we are forecasting that we are going to get a 10% decline in house prices this year,” Abbey Omodunbi, PNC Bank Senior Economist, told Yahoo Finance Live (video above). “There will be more of a balance in the housing market. There will be less demand and more supply. And that will contribute to the decline in house prices.”

Housing prices have come down since hitting their pandemic highs in the second quarter of last year. The U.S. median home price in March decreased 3.3% year over year to $400,706, according to Redfin, marking an 8% drop from peak pricing in May 2022.

However, the recent downturn in home prices has not been enough to offset high borrowing costs. Many first-time homebuyers still face affordability issues due to elevated home prices and mortgage rates still in the 6% range.

And buyers will also have to contend with stricter lending, Omodunbi predicted.

“Financial conditions will likely tighten in 2023,” he said. “We do expect the Fed to raise the Fed funds rate by a quarter of a percentage point going into the meeting in two weeks. And also after the bank failures in March, many banks are likely to be more cautious. So we might see some tighter lending standards.”

But for some buyers who remain in the market, they may find themselves at an advantage with softer prices, less competition, and potentially more supply.

"So we're going to see a lot of new construction that's going to come online, and that's potentially going to be beneficial for first-time homeowners," Omodunbi explained.

Builders were “cautiously optimistic” in April, fueled by buyers getting pushed to newly built homes due to limited existing-home listings, according to the National Association of Home Builders. In March, sales of new single-family constructions increased to 683,000 units, a 9.6% rise.

"A lack of resale inventory combined with many builders offering price incentives helped to push new home sales higher in March," said Alicia Huey, chairman of the National Association of Home Builders (NAHB) said in a press release published earlier this week.

This week, PulteGroup also reported quarterly results that topped expectations as buyers reentering the housing market flocked to new homes.

“Within an evolving macro environment, consumers across all buyer segments and price points continue to demonstrate a strong desire for homeownership,” PulteGroup President and CEO Ryan Marshall said in the press release.

Omodunbi offered a similarly rosy view.

"I think that as inflation moderates and supply chains continue to improve, we're going to see more construction come online,” he said, “which will be favorable to new homeowners."

Rebecca is a reporter for Yahoo Finance and previously worked as an investment tax certified public accountant (CPA).

Read the latest financial and business news from Yahoo Finance

This time last year, it seemed like the whole country was caught up in a home-buying frenzy. But thanks to high interest rates and stubborn inflation, “the housing market is pretty much on ice,” said Daryl Fairweather, chief economist for real estate analytics firm RedFin.

U.S. home sales are down 22% year over year according to March data from the National Association of Realtors.

This has caused significant price drops in some markets. But not in Tampa Bay.

The median sales price for Tampa, St. Petersburg and Clearwater is $395,000, a 1.3% increase from last year, according to March data from Greater Tampa Realtors.

Though home sales are down 15.4% in the Tampa Bay area, there are still more buyers than sellers, said Lei Wedge, a professor of finance at the University of South Florida Muma College of Business.

There were 6,513 active listings in March. That’s a 121.8% increase from last year, but still well below pre-pandemic era norms. By comparison, there were 11,816 active listings in February 2019.

In order to tip the scales back in favor of buyers, “you would have to have tons of people trying to get rid of their homes,” Wedge said.

Carol Hasbrouck, an agent with Luxury & Beach Realty in Pinellas County said many homeowners are hesitant to sell because they are already locked in at a lower mortgage rate.

“It creates challenges for buyers because they can’t find what they’re looking for,” she said.

The slowdown hasn’t been all bad for buyers though. Hasbrouck said there’s less competition from large investors, cash buyers and people who are willing to waive their rights to home inspections and other protections.

As the year progresses, Fairweather said prices may continue to grow some in the Tampa Bay area, but the rate of growth is expected to slow.

Falling mortgage rates could provide some relief. Right now the average 30-year fixed rate is around 6.9%. RedFin is forecasting that it will reach 5.5% by the end of the year.

Use of and/or registration on any portion of this site constitutes acceptance of our User Agreement (updated 4/4/2023), Privacy Policy and Cookie Statement, and Your Privacy Choices and Rights (updated 1/26/2023).

© 2023 Advance Local Media LLC. All rights reserved (About Us).

The material on this site may not be reproduced, distributed, transmitted, cached or otherwise used, except with the prior written permission of Advance Local.

Community Rules apply to all content you upload or otherwise submit to this site.

YouTube’s privacy policy is available here and YouTube’s terms of service is available here.

The average price for a house in the Hamptons hit a record $3 million in the first quarter, highlighting a shortage of trophy beach homes for sale and the resilience of wealthy buyers.

The average sales price in the New York beach community jumped 18% in the first quarter to $3.1 million, according to a report from Douglas Elliman and Miller Samuel. The average price in the Hamptons is now more than $1 million higher than the average sales price in Manhattan. That marks the largest gap between the two markets since data started being collected in 2005, according to Miller Samuel.

The surge reflects the continued shortage of homes listed for sale, along with sustained demand from wealthy homebuyers looking for a piece of the coveted Hamptons real estate. Brokers say that despite stock market volatility, rising mortgage rates, layoffs in tech and finance and fears of recession, the wealthy are still bidding and buying.

"We have more buyers than sellers," said Todd Bourgard, CEO of Douglas Elliman's Long Island, Hamptons and North Fork region. "The buyers are out there."

The high end of the Hamptons market is the strongest. In the luxury market — representing the top 10% of sales — both the median and average sales price broke records during the first quarter, with the average luxury price surging 33% to $16.1 million, according to Jonathan Miller, CEO of Miller Samuel.

More than 14% of sales in the luxury market were the result of bidding wars, Miller said.

"The high end remains unfazed to a certain degree," he said. "You have people who are making moves with less concern for the macro environment."

The Hamptons saw a number of mega-home sales in the first quarter. A 6.7-acre estate in East Hampton sold for $91.5 million in March, more than twice what it sold for in 2020. A 3,000-square foot home in Montauk once owned by Bernie Madoff sold for $14 million. A modern, 5,500 square-foot oceanfront home in Bridgehampton sold in an off-market deal for around $35 million, brokers say.

Even small homes in the Hamptons are fetching big prices: A mobile home in the Montauk Shores community sold for $3.75 million.

The lack of homes for sale, however, has led to a sharp drop in total deals. Sales volume in the first quarter plunged 57% to their lowest level in 14 years, according to Miller Samuel. While the inventory of listed homes increased by one-third from the first quarter of 2022, inventory is still about half the pre-Covid levels, Miller said.

Brokers add that many of the current listings are over-priced, making the number of sellable homes even lower. Brokers say that while demand from wealthy buyers is strong, they're disciplined on price and refuse to pay the peak prices of 2021 and early 2022.

"A lot of properties coming on to the market are not priced right," Miller said.

Brokers say sales could pick up over the summer, if more homes come on the market.

"As we go into spring and start heading into the summer, I think the market will get stronger," Bourgard said.

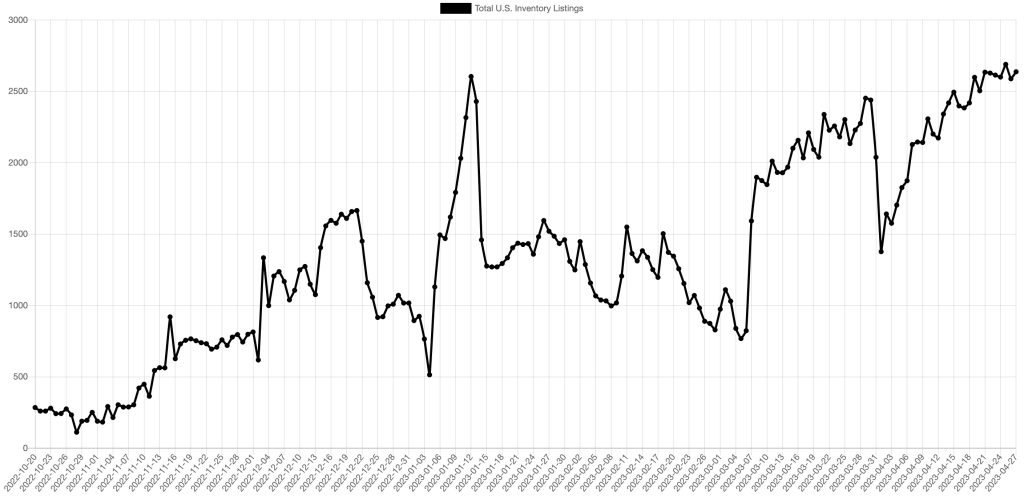

Tesla’s (TSLA) inventory in the US has reached a new high, which is worrisome at this time in the quarter, and it is pointing to price cuts maybe not working as well as the automaker intended.

Since the beginning of the year, Tesla has consistently reduced prices of its electric vehicles in the US to create more demand.

In some cases, prices were cut by over 20%.

During its earnings call last week, the automaker made it clear that it is monitoring new orders daily against production capacity, and it plans to continue adjusting prices in order to create the demand to match the production rate.

Unfortunately, there’s no easy way to track these metrics, but there’s a way to track Tesla’s inventory in the US, which can give us a general idea.

At the end of last quarter, Tesla disclosed having 15 days’ worth of inventory, which has been its highest in years. The automaker tried to justify it with vehicles in transit, but it’s hard to believe there were that many vehicles in transit at the end of the quarter.

Sure enough, new inventory data, which doesn’t include vehicles in transit, tracked by Matt Jung shows that Tesla’s new inventory vehicles in the US have reached a new high of around 2,600 vehicles:

We can see a big drop at the end of the quarter and after Tesla’s second-to-most recent price drop, but despite a second price drop this month, the inventory appears to keep climbing.

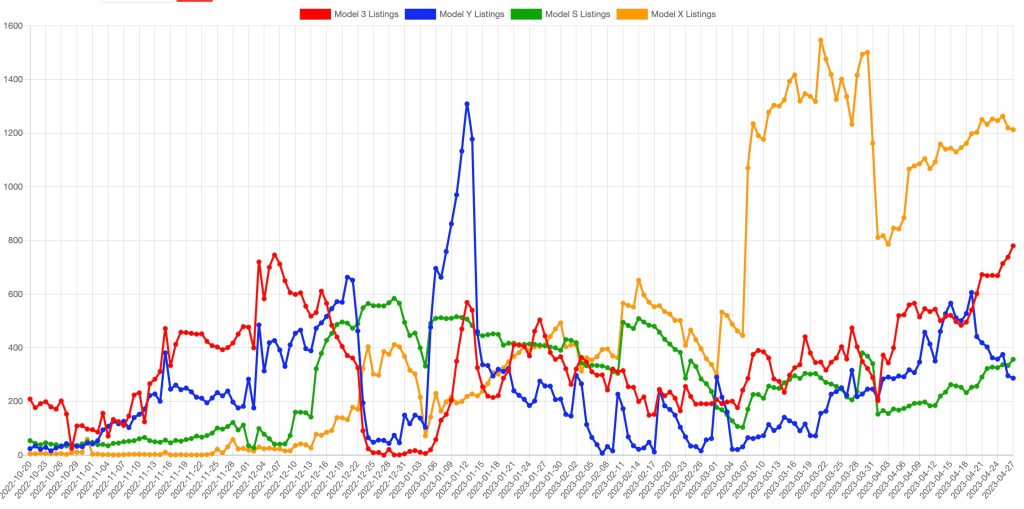

Interestingly, Tesla’s biggest problem appears to be the Model X:

The automaker appears to be stuck with over 1,200 Model X vehicles on inventory in the US.

Model 3 also appears to start being a problem with inventory jumping 50% over the second half of the month despite the recent price cuts.

The only good news is that the price cuts appear to have worked for the Model Y, which is now Tesla’s best-selling vehicle.

Model Y inventory was cut in half to about just 300 units following the two most recent price cuts.

Now it’s important to take these data points with a grain of salt since they also might be a result of Tesla deploying more inventory in the US during a short period of time ahead of switching production for other markets.

But regardless of that, in general, higher inventory is certainly not a good sign for demand.

It will be interesting to see if Tesla decides to again adjust prices down in the US – especially for Model X.

Although when it comes to the electric SUV, Tesla’s recent offer of six years of Supercharging for owners of older Model S and Model X vehicles to upgrade might have done the trick already, and it has yet to be reflected in the inventory vehicles.

The drug price “negotiation” mechanism Democrats included in last year’s inaptly named Inflation Reduction Act will reduce innovation and the introduction of possible new cures. But a recently released document by the Centers for Medicare and Medicaid Services also suggests regulators may utilize the “negotiation” process to discriminate against people with disabilities.

As the mother of a child with cystic fibrosis and as a former member of the National Council on Disability, I find that the centers’ proposals raise more troubling questions about Democrats’ brave new drug pricing world.

BIDEN'S PROMISES ON DRUG PRICES SOUND HALLUCINOGENIC

In March, CMS released a 91-page guidance document providing the agency’s initial views of the drug “negotiation” process. The document indicated that when considering various factors to determine the “fair price” for the drug, regulators would exclude research that uses quality-adjusted life years, or QALYs, “in a manner that treats extending the life of an individual who is elderly, disabled, or terminally ill as of lower value than extending the life of an individual” without those characteristics.

This phrasing in CMS’s guidance echoed language included in the Inflation Reduction Act, and similar language is contained in a section of Obamacare that established a federal institute for comparative effectiveness research. But prohibiting the use of QALYs only “in a life-extension context,” as CMS suggests in the guidance, takes a constrained view of discrimination in ways that contradict past administrative actions and other federal laws.

Prohibiting the use of discriminatory cost-effectiveness metrics solely when it comes to valuing the quantity of life (i.e., life extension) would allow regulators to use such metrics to evaluate the quality of life. And on that front, the QALY metric, by definition, considers people with disabilities as of “lesser” value than the nondisabled. Moreover, other alternatives to the QALY that CMS could utilize, such as the equal value of life year gained, discriminate based upon age and contain similar flaws regarding quality-of-life improvements.

In my comments to CMS regarding its guidance, I noted that federal health regulators had previously not taken such a restrictive view about what constitutes discrimination against people with disabilities. In 1992, then-Secretary of Health and Human Services Louis Sullivan rejected a Medicaid waiver application from the state of Oregon because the waiver “in substantial part values the life of a person with a disability less than the life of a person without a disability.”

Sullivan and HHS based their decision not on the narrow “life-extension context” referred to in the Inflation Reduction Act and Obamacare but on a broader definition of discrimination laid out in the Americans with Disabilities Act. Specifically, sections of the Oregon proposal weighed “quality of life” heavily in determining what services Medicaid would cover, which HHS concluded constituted discrimination against people with disabilities. Only after Oregon officials deleted such language from their application did federal regulators approve the waiver.

The Oregon precedent demonstrates that discrimination against the disabled can occur regarding both quality and quantity of life. As such, CMS should take a more expansive view of the factors excluded from consideration during the “negotiation” process to ensure the agency complies with the Americans with Disabilities Act.

Yet some Democrats object. At a recent Energy and Commerce Committee markup of House legislation designed to ensure that federal programs do not use QALYs or similar discriminatory measures, ranking member Frank Pallone (D-NJ) raised concerns that the bill “could be used to delay or disrupt the implementation of the drug price negotiations in the Inflation Reduction Act.”

It speaks volumes that some Democrats apparently believe the federal government cannot “negotiate” drug prices without discriminating against the most vulnerable. Regardless, CMS should follow the example of federal regulators three decades ago and insist on excluding any discriminatory cost-effectiveness metrics from the “negotiation” process.

CLICK HERE TO READ MORE FROM THE WASHINGTON EXAMINER

Mary Vought is the founder of Vought Strategies and a senior fellow at the Independent Women's Forum. She's a former presidential appointee to the National Council on Disability.

Finance Minister Bezalel Smotrich on Thursday said he was striving to avert an approaching sharp increase in the price of basic dairy products, while blaming the hike on his predecessor and the previous government.

MK Avigdor Liberman, leader of the opposition Yisrael Beytenu party and finance minister when the current government took over at the end of last year, blasted Smotrich for not taking responsibility for the country’s economic situation and “whining” about those who came before him. He also called on Smotrich to resign.

The exchange came after the Agriculture Ministry announced Monday that price-controlled dairy items were going up by 16 percent from the beginning of May.

A 1-liter carton of 3% milk will jump from NIS 6.23 ($1.72) to NIS 7.23 ($1.99), while a 250-gram tub of soft white cheese will rise from NIS 4.98 ($1.37) to NIS 5.77 ($1.59).

A 200-millimeter sour cream will cost NIS 2.81 (77 cents), up from NIS 2.4 (66 cents). Emek yellow cheese will go from NIS 37 ($10.19) to NIS 51 ($14.05 ) per kilo.

Get The Times of Israel's Daily Edition by email and never miss our top stories

“Due to an agreement signed by Liberman in the previous government, the price of controlled dairy products are set to automatically increase by 16% at the beginning of next month,” Smotrich said in a statement. “We won’t let this happen.”

“Over recent weeks, the professionals at the Finance Ministry and I have been examining several ways to moderate the increase and formulate solutions that will make it easier for the public and cover the opacity and irresponsibility of [previous prime minister Yair] Lapid and Liberman.”

Finance Minister Bezalel Smotrich presents economic and budget plans for 2023-2024, February 28, 2023. (Courtesy)

Liberman in turn blamed the government that preceeded his term as finance minister, a coalition led by current Prime Minister Benjamin Netanyahu who returned to power following November 2022 elections.

“When I took up my duties as finance minister, I inherited the Israeli economy in a very difficult situation, after irresponsible and populist management that scattered money from a helicopter for the sake of political achievements,” he wrote.

“The time has come for the current Israeli government and Finance Minister Smotrich to stop whining, complaining, and blaming the whole world for their failures,” Liberman said. “Learn your lesson and resign. The citizens of Israel deserve real, responsible, and non-populist leadership.”

Despite living with inflation levels at around half the rate of the rest of the developing world, Israeli consumers have felt the pinch of rising prices in nearly every consumer category.

Dairy prices in Israel are a sensitive issue and have sparked reactions that often snowball into mass demonstrations against the high cost of living. In 2011, the so-called cottage cheese protest sparked weeks of social unrest, resulting in supermarkets lowering dairy prices and policy reforms aimed at lowering consumer prices.

Dairy producers say that the price of the food grains for cattle that account for a significant part of the cost of producing dairy items has jumped, raising costs.

Yisrael Beytenu party chairman MK Avigdor Liberman at the Knesset, on April 16, 2023. (Yonatan Sindel/Flash90)

In mid-November, dairy giant Tnuva announced a roughly 4.7% increase in the price of hundreds of dairy products whose prices were not government-regulated, and some non-dairy substitutes. Tnuva has explained the increases as being due to the “sharp rise of [the cost of] raw milk,” which has increased by 24% since 2019 and has added NIS 400 million ($115 million) in expenses to the company.

Shufersal, Israel’s largest supermarket chain, said it would oppose the price hike by taking the affected products off its shelves, as it previously did with other large food manufacturers like Unilever and Tara, the country’s second-largest dairy processor.

But Shufersal later said it would consent to raise the price on certain products, ending its boycott of the brand over the rising costs after only a few weeks.

Next 15 Group (LON:NFG) has had a rough three months with its share price down 20%. It is possible that the markets have ignored the company's differing financials and decided to lean-in to the negative sentiment. Fundamentals usually dictate market outcomes so it makes sense to study the company's financials. Particularly, we will be paying attention to Next 15 Group's ROE today.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

View our latest analysis for Next 15 Group

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Next 15 Group is:

2.6% = UK£3.0m ÷ UK£114m (Based on the trailing twelve months to January 2023).

The 'return' refers to a company's earnings over the last year. One way to conceptualize this is that for each £1 of shareholders' capital it has, the company made £0.03 in profit.

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

It is hard to argue that Next 15 Group's ROE is much good in and of itself. Not just that, even compared to the industry average of 5.7%, the company's ROE is entirely unremarkable. For this reason, Next 15 Group's five year net income decline of 72% is not surprising given its lower ROE. We believe that there also might be other aspects that are negatively influencing the company's earnings prospects. For instance, the company has a very high payout ratio, or is faced with competitive pressures.

That being said, we compared Next 15 Group's performance with the industry and were concerned when we found that while the company has shrunk its earnings, the industry has grown its earnings at a rate of 12% in the same period.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. This then helps them determine if the stock is placed for a bright or bleak future. If you're wondering about Next 15 Group's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

In total, we're a bit ambivalent about Next 15 Group's performance. While the company does have a high rate of reinvestment, the low ROE means that all that reinvestment is not reaping any benefit to its investors, and moreover, its having a negative impact on the earnings growth. With that said, we studied the latest analyst forecasts and found that while the company has shrunk its earnings in the past, analysts expect its earnings to grow in the future. To know more about the company's future earnings growth forecasts take a look at this free report on analyst forecasts for the company to find out more.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

[unable to retrieve full-text content]

Chipotle earnings: Despite price increase customers 'are coming back in greater numbers,' CFO says Yahoo Finance[unable to retrieve full-text content]

Oil Traders Are Violating the G-7 Oil Price Cap in Asia, Researchers Say Bloomberg

By Adria Calatayud

Orange SA reported results for the first quarter on Wednesday. Here is what you need to know:

REVENUE: The French telecommunications company reported revenue of 10.62 billion euros ($11.66 billion) for the first quarter, against analysts' expectations of EUR10.60 billion, according to consensus estimates provided by Orange....

[unable to retrieve full-text content]

Orange Sales in Line with Target as Price Hikes Taken in Stride Bloomberg[unable to retrieve full-text content]

Used car brands with the biggest price increases in 2023 Autoblog/cloudfront-us-east-1.images.arcpublishing.com/gray/BDXNIDG3TVBX5B5DZMWR66Q3VM.jpg)

PHOENIX (3TV/CBS 5) -- If you’re driving to California soon, it will actually cost you less money to fill up your gas tank if you live in Maricopa County.

According to AAA, gas in Maricopa County is currently higher than in Los Angeles County, San Diego County, and Santa Barbara County. Right now, AAA says gas in the Phoenix area is averaging $5.02 a gallon, even more than some Hawaiian islands like Oahu or Maui.

“It really comes down to a product of bad timing. There are some refinery problems, refinery maintenance happening in Texas and New Mexico that really hurt a lot of the supply side regionally here in Arizona, and also at the same time OPEC made the decision to cut part of their supply to the global oil market,” Julian Paredes with AAA said.

As we get into summer, more Arizonans take road trips so demand goes up. On top of that, the summer gas blend is more expensive than winter fuel.

We asked Paredes if prices would stay in the $5+ range or go up even higher. He says “typically prices stick around throughout all summer.”

“It’s certainly possible to see gas prices at this level for the next few months. Hopefully, we won’t, there’s a lot of different factors that go into that, but $5 gas for the next few weeks is definitely possible,” he added.

The average for Arizona is $4.69, more than $1 above the current national average of $3.66 a gallon.

Late Monday morning, Rep. Ruben Gallego sent a letter to President Biden asking him to use his power to address the rising cost of fuel.

“Arizona families should not be forced to pay more than a dollar a gallon over the national average for gas,” said Gallego. “It’s even more outrageous that at some gas stations, there are no options left but expensive Premium gas. Our state shouldn’t be punished unfairly for the actions of a few major oil companies. We need the Administration to address these issues and lower costs.”

The average for Arizona is $4.69, more than $1 above the current national average of $3.66 a gallon.

Copyright 2023 KTVK/KPHO. All rights reserved.

/cloudfront-us-east-1.images.arcpublishing.com/gray/BDXNIDG3TVBX5B5DZMWR66Q3VM.jpg)

PHOENIX (3TV/CBS 5) -- If you’re driving to California soon, it will actually cost you less money to fill up your gas tank if you live in Maricopa County.

According to AAA, gas in Maricopa County is currently higher than in Los Angeles County, San Diego County, and Santa Barbara County. Right now, AAA says gas in the Phoenix area is averaging $5.02 a gallon, even more than some Hawaiian islands like Oahu or Maui.

“It really comes down to a product of bad timing. There are some refinery problems, refinery maintenance happening in Texas and New Mexico that really hurt a lot of the supply side regionally here in Arizona, and also at the same time OPEC made the decision to cut part of their supply to the global oil market,” Julian Paredes with AAA said.

As we get into summer, more Arizonans take road trips so demand goes up. On top of that, the summer gas blend is more expensive than winter fuel.

We asked Paredes if prices would stay in the $5+ range or go up even higher. He says “typically prices stick around throughout all summer.”

“It’s certainly possible to see gas prices at this level for the next few months. Hopefully, we won’t, there’s a lot of different factors that go into that, but $5 gas for the next few weeks is definitely possible,” he added.

The average for Arizona is $4.69, more than $1 above the current national average of $3.66 a gallon.

Late Monday morning, Rep. Ruben Gallego sent a letter to President Biden asking him to use his power to address the rising cost of fuel.

“Arizona families should not be forced to pay more than a dollar a gallon over the national average for gas,” said Gallego. “It’s even more outrageous that at some gas stations, there are no options left but expensive Premium gas. Our state shouldn’t be punished unfairly for the actions of a few major oil companies. We need the Administration to address these issues and lower costs.”

The average for Arizona is $4.69, more than $1 above the current national average of $3.66 a gallon.

Copyright 2023 KTVK/KPHO. All rights reserved.

Fast-forward to April 2023, and not only have mortgage rates stabilized around 6.5% this spring but the housing correction has also lost steam. That explains why Zillow stopped issuing downward forecast revisions, and is actually starting to raise its outlook.

Heading forward, Zillow economists expect U.S. home values as tracked by the Zillow Home Value Index (ZHVI) to rise 1.7% between March 2023 and March 2024.

However, that’s its national outlook. If the bifurcated housing market correction—which has been sharp out West and mild in the East—has reinforced anything it’s that real estate is indeed local.

Among the 400 largest housing markets tracked by Zillow, the company expects 294 markets to see positive home price growth between March 2023 and March 2024, while it expects four markets to remain flat and home prices to fall over the next 12 months in 102 markets.

Just one month ago, Zillow expected 238 markets to rise between February 2023 and February 2024, while it expected 156 markets to decline during that same span.

Let’s take a closer look at Zillow’s latest forecast.

Between March 2023 and March 2024, Zillow expects some of the biggest home price upticks to occur in markets like Knoxville, Tenn. (+4.5% forecasted home price growth), Savannah, Ga. (+4.5%), Winston-Salem, N.C. (+4.4%), Johnson City, Tenn. (+4.2%), and Wilmington, N.C. (+4.1%). Simply put: Zillow's forecast model expects a great deal of strength in the U.S. Southeast.

"Many markets may have already seen prices bottom out, and those price declines may be helping entice more buyers this spring," wrote Jeff Tucker, senior economist at Zillow, in a recent report. "The very low [levels of] inventory is likely a major reason that home prices [in some markets] have begun to rise again."

However, Zillow economists do expect home price declines to occur between March 2023 and March 2024 in markets like San Francisco (-2.6% forecasted decline), Boulder, Colo. (-1.6%), Denver (-1.3%), Reno, Nev. (-1.3%), and Las Vegas (-1%).

Relative to economists at Moody's Analytics (which expects national home prices to fall 4.2% in 2023) and Fannie Mae (which expects national home prices to fall 1.2% in 2023), Zillow's team is on the optimistic side.

Among the 400 largest regional housing markets tracked by Zillow, 182 remain below their 2022 peak price, while 218 markets, as of March 2023, are back to (or above) their 2022 peak price.

Among the down markets, the majority are located in the Western half of the country.

The reason is pretty straightforward: Western housing markets are hyper rate-sensitive.

As Fortune has previously reported, Not only does the West have a high concentration of rate-sensitive tech employers, but it also has overheated home prices that are vulnerable to mortgage rate spikes. If Western buyers were already stretching themselves then (see here) while mortgage rates were low, it only makes sense that they'd finally push back once mortgage rates spiked. Cue falling home prices.

Want to stay updated on the housing correction? Follow me on Twitter at @NewsLambert.

[unable to retrieve full-text content]

UK Home Sellers Slow Pace of Increase in Property Asking Prices Bloomberg[unable to retrieve full-text content]

Vulcan Energy Resources (VULNF): Price Down, Numbers Clearer, This Looks Good Seeking Alpha[unable to retrieve full-text content]

Vulcan Energy Resources (VULNF): Price Down, Numbers Clearer, This Looks Good Seeking Alpha[unable to retrieve full-text content]

Vulcan Energy Resources (VULNF): Price Down, Numbers Clearer, This Looks Good Seeking Alpha

Amazon-owned iRobot is kicking off its Mother’s Day celebrations early with deep discounts on its most popular Roombas, from bargain-priced bump-and-run models to self-emptying vacs and robot mops.

Among the standouts of iRobot’s Mother’s Day deals is the Roomba j7+, an obstacle-avoiding robot vacuum that maps your floors and comes with a self-emptying bin, allowing you to go without emptying dust and debris for weeks at a time. Normally priced at $799.99, the Roomba j7+ is our current top pick for robot vacuums (I have two at home), and it will sell for $200 off during the iRobot sale.

If you’re looking for a Roomba that can handle spills as well as dirt, the Roomba Combo j7+ may fit the bill. Similar to the standard j7+, the Combo J7+ can empty its own bin and map floors, but this robovac double as a mop that automatically retracts its mop head the moment it detects carpet. Retailing for $1,099.99, the Roomba Combo j7+ is $200 off for Mother’s Day.

Also catching our eye is this Roomba s9+ and Braava Jet m6 bundle. Another self-emptying and floor-mapping vacuum, the Roomba s9+ boasts “PerfectEdge” technology for cleaning the corners and edges of your rooms, while the Braava Jet m6’s “Precision Jet Spray” is designed to bust kitchen grease and other messes. The Roomba s9+ and Braava Jet m6 typically sell for $1499.98 as a bundle, but you can snag them both for a steep $499.99 discount for Mother’s Day.

Going from the most expensive Roombas to the most affordable, the reliable Roomba 694 is a terrific bump-and-run model that will clean your floors with iRobot’s “Dirt Detect” technology, while Wi-Fi support lets you set schedules via iRobot OS and trigger cleaning with Alexa or Google Assistant. At a list price of $274.99, the Roomba 694 is already a pretty good deal, but it’s a steal at $95 off.

See below for all the Roomba deals that iRobot is offering for Mother’s Day:

[unable to retrieve full-text content] Companies' reluctance to roll back price rises poses US inflation risk Financial Times from...